How Rolling Funds Will Impact Fundraising

Rolling funds is the next big thing when it comes to fundraising. Did you know that rolling venture funds work for experienced

By teammarquee . January 10, 2022

Rolling funds is the next big thing when it comes to fundraising. Did you know that rolling venture funds work for experienced as well as emerging fund managers alike? The experienced fund managers can continuously accept new capital commitments, resulting in an increasing pool of capital to invest in great startups. On the other hand, the emerging managers require less capital to start investing.

What Are Rolling Funds?

Instigated by Angelist, rolling funds structure allows to raise money on a continuous basis – creating a new fund structure as frequently as every quarter. A new fund remains open to new accredited investors.

Since rolling funds fall under the SEC’s Rule 506(c), fund managers can market them publicly. However, rolling funds are relatively new, multiple early benefits have to light. Having said that, innovation will lead to numerous advantages.

To learn more about rolling funds, their benefits and how they are different from traditional funds, read more below:

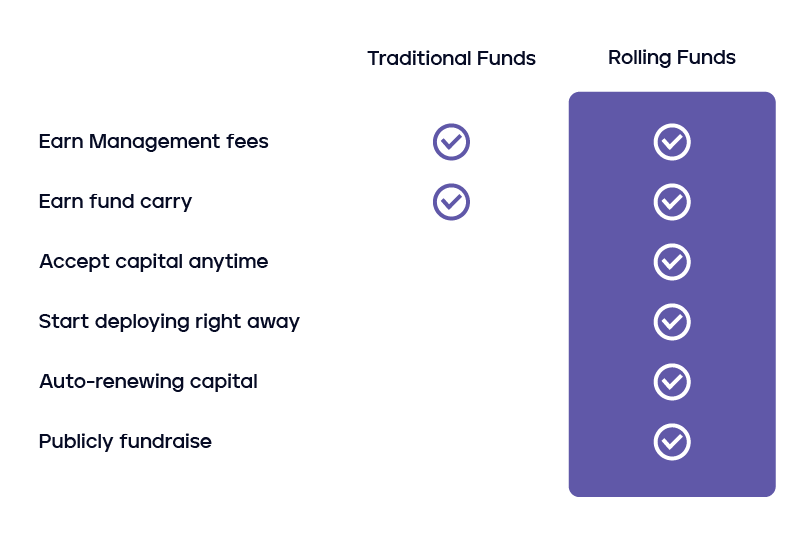

Rolling Funds vs Traditional Funds

Let us discuss how rolling funds are different from traditional funds via the below mentioned points to give you a proper understanding:

1. Rolling funds were created as a potential path for emerging venture capitalists who can start and close their first deal in a faster manner.

On the other hand, traditional funds take a longer period to close. A fund manager will go to multiple LPs – family offices, high net worth individuals, and other investment firms, to raise a minimum capital commitment.

2. Through rolling venture funds, fund managers can fundraise publicly.

While, traditional fund deals are done behind closed doors. Once the first tranche of the fund is raised, only then a fund manager can publicly announce it.

3. In rolling investment, fund managers raise new capital commitments on a quarterly basis and invest as they go, hence the name – rolling money.

However, traditional funds are invested with a 10 year return cycle, LPs and investors are legally bound for a decade and the money keeps flowing till the capital commitment is closed.

Now that we are aware about how rolling investment stands out from tradition one, let us walk you through the benefits of the same.

Benefits Of Rolling Funds

Rolling funds have the capability to transform the entire picture of venture capital space. Let me walk you through the benefits that rolling investments have to offer.

1. Flexible LP fundraising

Limited partners can subscribe for quarterly funds in advance and easily commit more or less capital as their investment goals change. Rolling funds give VC’s the opportunity to raise money via limited partners on a regular basis.

LPs follow a flexible, quarterly investment schedule rather than a one-time commitment to a fund. If a VC is making good bets and investing right, LPs can continue backing them up by providing them with more resources. On the other hand, if the LP decides that they don’t want to continue backing an investor, they can stop allocating money to them immediately.

2. Allowing all types of investors to raise funds

Despite the fact that you are an aspiring investor to an experienced one, rolling funds allows you to get started with less up front capital. Angelist can also manage facets like legal and administrative, which in turn decrease the overall capital that is required to get started.

It also provides minimum time commitment and allows the investors to invest quarterly. Not only this, but these funds have simplified the process of raising funds by minimising the cost as well as the effort involved behind it. Hence, more funding options for startups will start emerging.

3. Shortening feedback loops

As you already know, rolling investments let LPs make small periodic investments which is much easier than writing huge checks every 10 years. Startups take a long time to reach full maturity so shortened feedback loops will help venture capitalists to understand the performance of companies in real time and make informed decisions.

In simple words, if the LPs have many companies in their portfolio, the new structure will allow them to figure out where they want their money invested by looking at the real time performance of the companies.

How Rolling Funds Will Impact Fundraising?

As discussed earlier, funding options for startups will increase with rolling funds since it has the capability to impact the current VC fundraising structure. Let’s discuss this in detail, shall we?

1. Early stage investing

Rolling funds impact the early stage investing process. Some funds might grow more than anyone can foresee, all thanks to the nature of compounding. Traditionally VCs waited a long time to see if their fund is making any progress or not. But with rolling funds, LPs can see the result in real time and would want to get in on the future rounds. This way, a successful fund, would waise additional LP capital.

2. Increasing capital for founders

With emerging investor entries in the rolling fund structure will automatically create pressure on the traditional players in the current ecosystem and lead to more competition for deals. So, increasing the number of VCs will result in increasing the capital for founders and in turn lead to better prices.

3. Making the process efficient

The rolling fund era will help founders make the fundraising process more efficient and ease out the exit pressure. Since the LPs can raise funds on a quarterly basis, it does not create much of an issue as caused by having to raise a giant new fund every 10 years. This way founders will not find themselves under the pressure of selling off their company from the investors.

What Is the Rolling Fund Fees Structure?

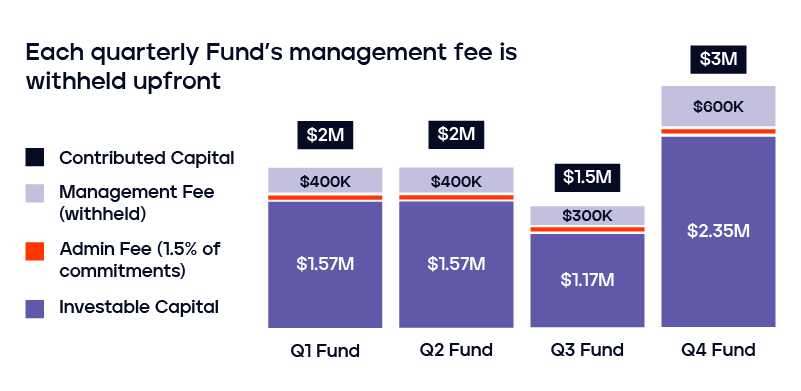

Every venture capital fund has a fess involved, so does rolling fund. The fees structure associated with these funds is explained below:

- Administration fees: The administration fee linked to rolling funds is 0.15%. This fee is similar to that of traditional funds and syndicates.

- Management fees: Generally, the management fees associated with rolling funds is mostly 2% but note that this can vary from 0% to 3%.

It goes without saying that fund management platforms like AngelList also charge similar fees in return for their services. The fees for operating rolling funds is generally similar to other types of funds that are already on these platforms. However, the fees associated with rolling funds might decrease in the future considering operational efficiency and scale of the rolling fund model.

Below is an example from AngelList to give you a better idea:

Final Words

Despite the fact that you are either an experienced fund manager or an emerging fund manager, rolling funds is the next big thing when it comes to fundraising and it will have a huge impact on the process. Not only will it be beneficial for the founders but will also give new and vast opportunities to them in order to raise funds on a regular basis.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.