Latest Articles

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape

The Rise of Private Equity: A Comprehensive Overview

The ascent of Private Equity marks a transformative trend in investments. Fueled by flexible strategies, active management, and a quest for superior returns, Private Equity firms engage in diverse sectors, fostering growth and reshaping industries. This comprehensive overview explores its strategies, impact on businesses, and evolving role in the dynamic global economic landscape....

Venture Capital Funding: What You Need to Know

Venture Capital Funding is a dynamic financing avenue for startups, involving investors providing capital in exchange for equity. Key considerations include a robust business plan, team expertise, and market potential. The funding process spans various stages, from seed to Series funding, with exits through IPOs or acquisitions. Understanding this landscape is crucial for aspiring entrepreneurs....

Top 10 Private Equity Firms: A Comparative Analysis

In dissecting the top 10 private equity firms, factors like assets under management, historical performance, and industry focus come under scrutiny. Rankings hinge on deal success and financial prowess. Investors scrutinize management styles, risk mitigation, and innovative strategies, aligning their portfolios with firms demonstrating a strong track record and a strategic vision....

Strategies to Find Investors for Your Startup

Discovering investors for your startup involves strategic networking at industry events, utilizing online platforms like AngelList, and tailoring pitches to align with investor interests. A well-prepared business plan is essential, demonstrating vision and scalability. Building a strong team, avoiding common mistakes, and exploring alternative funding sources contribute to a successful investor search....

Navigating the World of Angel Investors and Private Investors

ChatGPT Embarking on entrepreneurial journeys, startups navigate the realm of angel and private investors. These individual backers, motivated by financial returns and a passion for innovation, provide crucial capital. As strategic partners, they not only fund but mentor, shaping the trajectory of startups and propelling them towards success in the competitive business landscape....

Investment Banking 101: Understanding the Basics

Investment banking is a financial cornerstone, capital markets and corporate finance. From advising on mergers to underwriting IPOs, its multifaceted role spans capital raising, trading, and risk management. Rooted in financial expertise, investment banking navigates the complex terrain of global finance, steering businesses toward growth and facilitating economic vitality....

Private Markets and Investment Strategies

Navigating private markets demands strategic acumen. Diversify with private equity, venture capital, or real estate for unique opportunities. Due diligence is paramount; investors engage actively, accepting longer horizons and potential volatility. This lies in potential high returns, but understanding risks and regulatory impacts is crucial for a well-informed investment strategy....

Choosing the Right Financial Service for Your Needs

Choosing the right financial service is important for your financial well-being. Consider factors like your goals, fees, and reputation when selecting a provider. Whether opting for a traditional bank or an online institution, prioritize customer service and security. Regularly reassess to ensure your chosen services align with your evolving financial needs and aspirations....

The Power of Networking: Finding Angel Investors Online

Entrepreneurs hold a potent tool in the digital age—online networking to unearth angel investors. Platforms like AngelList and strategic engagement on LinkedIn amplify visibility. Crafting compelling pitches, showcasing industry expertise, and building authentic connections open doors. The power lies in navigating virtual realms, turning digital handshakes into transformative investment opportunities....

The Resurgence of Banking: Trends and Insights

The resurgence of banking is marked by a transformative wave, driven by digital innovation, fintech collaborations, and a heightened focus on customer-centricity. Traditional banks adapt to evolving trends, embracing technologies, and sustainable practices. This dynamic landscape shapes a future where convenience, security, and tailored experiences define the banking experience....

Topic: Exploring Seed Investors: A Critical Step for Startups

Navigating the startup landscape involves understanding the role of seed investors. These early-stage backers provide vital capital, mentorship, and strategic guidance. Startups seeking seed investment must present compelling ideas and plans for growth, as the relationship extends beyond funding, shaping the trajectory and success of the entrepreneurial venture....

The Basics of Investment: A Beginner’s Guide

Embarking on the investment journey as a beginner involves understanding key principles. The primary goal is wealth growth, considering factors like risk tolerance and investment types such as stocks, bonds, and real estate. Crafting a personalized strategy, diversifying, and staying informed are essential steps toward building a successful and resilient investment portfolio....

Ensuring Investor Trust: Building Credibility from Day One

"In the bold competitive world of startups, ensuring investor trust is paramount. Building credibility from day one establishes a solid foundation. Transparent communication, ethical conduct, and a focus on delivering on promises are key elements in attracting and maintaining the confidence of potential investors, setting a course for long-term success."...

Crafting a Winning Pitch Deck: A Step-by-Step Guide

In the competitive world of business, a winning pitch deck can be the key to success. It's more than just slides; it's a story that captures the essence of your venture. In this step-by-step guide, we'll explore the art of crafting a compelling pitch deck, empowering entrepreneurs to secure investments, partnerships, and support for their vision....

Staying Ahead of Fundraising Trends: Insights for 2024

"In our quest to make a meaningful impact, staying ahead of the fundraising curve is imperative. As we approach 2024, fundraising is evolving rapidly. Donor behaviors, technology, and social issues are catalysts of this transformation. Join us to explore strategies and insights vital for success in 'Staying Ahead of Fundraising Trends: Insights for 2024.'"...

The Future of Fundraising: Tech Innovations and Trends

The future of fundraising is being reshaped by tech innovations and emerging trends. From artificial intelligence optimizing donor engagement to blockchain ensuring transparent transactions, nonprofits are exploring cutting-edge solutions. In this dynamic landscape, embracing technology responsibly while maintaining transparency and ethical standards is paramount....

Navigating the Seed Funding Stage: Tips from Venture Capitalists

Navigating the seed funding stage is a crucial step for startups. Venture capitalists advise entrepreneurs to focus on idea validation, build strong teams, and create compelling pitches. Traction and user acquisition are vital, as is demonstrating a solid product-market fit. Effective communication and relationship-building with investors also play a key role in securing seed funding....

Choosing the Right Path: Venture Capital or Angel Investment?

In the startup universe, venture capital offers jet fuel for growth, enabling rapid expansion but often demanding equity and control. On other hand Angel investment, with its personal touch and mentorship, nurtures early-stage ideas, tolerating risk and shaping promising concepts into future success stories. Both paths are crucial, each with its unique advantages....

How to Approach Angel Investors: Do’s and Don’ts for Startups

In the challenging world of startup funding, approaching angel investors is a critical step. Learn the essential "do's" for success, And avoid common "don'ts" ...

A Comprehensive Guide to Startup Fundraising Strategies

Unlock the secrets to successful startup fundraising with our comprehensive guide. Explore strategies from bootstrapping to crowdfunding. ...

The Impact of Venture Capital on Startup Growth

Get valuable insights by exploring the relationship between startups and venture capital. Ideal for entrepreneurs and investors alike....

The Evolution of Startups: From Seed Funding to Series Funding

Whether you are starting or scaling your business, this guide will take you through every stage of fundraising, including the growth of fundraising culture, and what it all means for you....

Demystifying the Venture Capital Investment Process

Unlock the secrets of venture capital with our comprehensive guide. Learn about the investment process, key players, and insider tips for securing funding. Demystify venture capital today!...

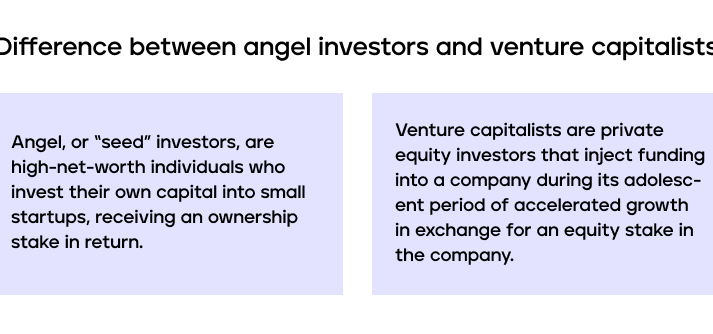

The Key Differences Between Venture Capital and Angel Investors

Explore the world of startup funding and the key differences between Venture Capital and Angel Investors. Learn how to make informed decisions for your business journey, weighing the pros and cons of each financing option. ...

The Role of Due Diligence in Venture Capital Investments

What is Due Diligence, why is it important, and what goes into it? Find out here!...

The Pros and Cons of Working with Angel Investors vs. Venture Capitalists

Explore the advantages and disadvantages of partnering with angel investors and venture capitalists in your business. Align your goals and aspirations with Marquee Equity....

How to Incorporate Investor Feedback into Your Business

Learn how to effectively incorporate investor feedback into your business strategy. Discover practical tips, techniques, and best practices to enhance decision-making....

How to Identify Potential Strategic Partners for Fundraising

Discover effective strategies for identifying potential strategic partners to fuel your fundraising efforts. Learn key techniques and best practices with Marquee Equity....

Fundraising for Small Businesses: Tips and Strategies

Discover valuable tips and effective strategies for fundraising for small businesses. Explore funding options, networking techniques, and financial planning tips. ...

The Anatomy of a Successful Pitch Deck: What to Include and How to structure it

Uncover the key components and effective structuring techniques for a successful pitch deck. Learn what to include in your pitch deck to capture investors' attention. Learn more. ...

How to Find the Right Investors for Your Startup: Strategies for Identifying and Targeting Potential Investors

Discover effective strategies for finding the ideal investors for your startup. Explore networking techniques, and investor research to optimize your fundraising efforts....

The Role of Storytelling in Fundraising: How to Craft a Compelling Narrative that Resonates with the Investors

Explore the powerful role of storytelling in fundraising and learn how to create a captivating narrative that resonates with investors. ...

The Impact of Globalization on startup fundraising

Uncover the significant impact of globalization on startup fundraising. Discover how globalization has reshaped the fundraising landscape and challenges for startups worldwide....

Angel Investing: An Alternative Way to Raise Equity Financing

Discover the power of angel investing as an alternative way to raise equity financing for your startup. Explore the benefits, considerations, and strategies with Marquee Equity....