What’s your company worth? How valuations work.

300+ companies. Is how many startups our team at Marquee Equity speaks to each week. The top 3 questions we hear are: How much

By teammarquee . December 15, 2021

300+ companies. Is how many startups our team at Marquee Equity speaks to each week.

The top 3 questions we hear are:

- How much should I be raising?

- What valuation should I be raising at?

- What are the chances of me successfully raising?

How much should one be raising? The thumb rule is to raise an amount that fuels you for 18–24 months.

Chances of successfully raising? My firm belief is if a founder is determined enough, they will end up raising capital, eventually, from someone. The chances of raising are a 100% — if you’re committed to doing it, no matter what. Who you raise from and how much and at what terms will vary, but if you go at it with everything you have — you will end up raising. There are several published examples of this.

What valuation should one be raising at? Well, this one’s slightly complicated. Lets have a look.

One has to appreciate, startup valuations do not follow most valuation techniques used to value more established, later stage companies. Startup valuations are a lot more demand and supply driven, as opposed to numbers/metrics driven.

That being said, there are a variety of ways in which companies can be valued. I will allude to these methods and links to other helpful articles detailing these methods.

9 Methods to Value Companies

- Berkus Method — Typically for valuing pre revenue startups that can be assumed to reach at least $20M in revenues in the first 5 years

You can read more about the Berkus method here

2. Risk Factor Summation Method — Also meant for pre revenue startups, but slightly more evolved than the Berkus method.

The idea here is to give a base value to a company and then adjust said value on the basis 12 risk factors inherent to company building

You can read more about this method here

3. Scorecard Valuation Method — Valuation based on a weighted average value adjusted for a similar company. Mostly used by angels to value pre revenue startups.

Read more about this method here

4. Comparable Transaction Method — Valuation based on comparing select metrics of your company with those of similar companies that have exited to determine a value

You can read more about this method here

5. Book Value Method — Mostly irrelevant to startups as it works based on the tangible assets of a company, while startups typically tend to be valued on their intangible assets

6. Liquidation Value Method — Based on the scrap value of the tangible assets of a company and therefore, irrelevant to startups

7. Discounted Cash Flow Method — Used for companies with revenue, but mostly irrelevant to post revenue startups due to the nature of startup/tech valuations

8. First Chicago Method — Takes the best, medium and worst case valuation scenarios for a company and provides a weighted average of those as the valuation.

This method is used for post revenue startups and you can read more about it here

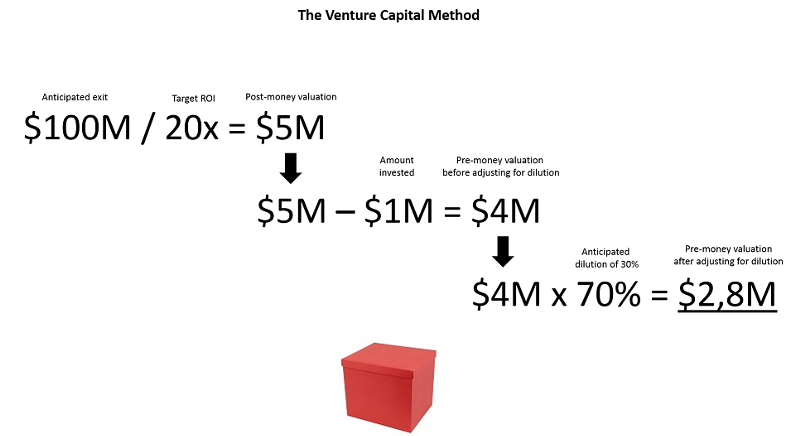

9. The Venture Capital Method — This is the reverse math investors in tech startups run to reach a valuation number.

It will consider their anticipated exit, their target ROI, the amount of capital that they’d need to invest to get the company to the targeted exit amount and factors in dilution, to reach a pre money valuation number.

You can read more about it here

The Fact: The valuation of early stage companies has a lot to do with the demand they have with investors — and demand with investors depends on a number of factors.

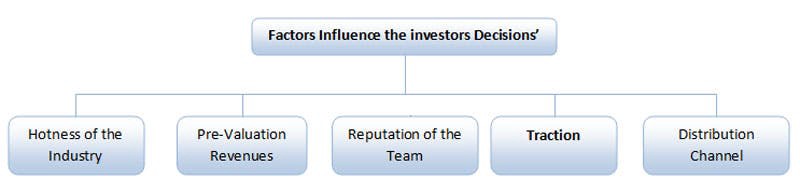

Factors that Influence Demand with Investors

- “Hotness of Industry” — some spaces grow faster than others. Some spaces are hot today, cold tomorrow. Some spaces were cold yesterday but hot today and will get hotter tomorrow. Investors move in packs and the space you’re in matters — what’s hot today? AI, Fintech, SaaS, Health-tech, IoT, Conversation tech to name a few

- Team — Experienced founders with prior exits will have a lot more demand than first time ones

- Traction — nothing speaks of success as traction does

- Revenues — more relevant to B2B startups than B2C ones

- Distribution channels — the ability to onboard customers quick due to access to proprietary distribution channels

- Interest from other investors — if you’ve convinced one, its a lot easier convincing the ones who’ve been on the fence about you

So, how much is your company worth?

Broadly speaking, for early stage companies, valuations will depend on:

a. How much needs to be raised

b. How much the founders are prepared to dilute

c. Demand of the startup with investors

Do read this excellent article by Pierre Entremont of Otium Venture

How important is your valuation?

Not very, especially during the first few rounds (more on this in another piece, soon).

Startup founders should focus on raising adequate capital, ideally from the best suited investors for their company. Valuation should not be a fighting point between founders and investors at initial stages.

If the company does well, what you lost in equity during earlier rounds will get compensated as value created in later rounds.

The amounts you’re able to raise and the fit an investor has with you are more important than valuations at early stages.

I hope you’ve found this useful and I’ll be back with more on all things fund raising in subsequent posts.

Also, if you’re considering raising capital, our team at Marquee Equity would love to work with you in helping you access the best angel and institutional investors in the world.

All the very best to you!

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.