Illustrated Journey Through the Startup Funding Stages: Seed to IPO

Learn the stages of startup funding in detail, from pre-seed to IPO. Our comprehensive guide includes expert tips and advice to help you secure funding for your startup.

By teammarquee . March 17, 2023

The process of starting and growing an early-stage company usually involves several stages of funding. These stages represent the different phases of development a company goes through and the different types of startup funding stages that occur in a business cycle. The funding stages highlight the company’s progress, such as seed capital funding for initial growth provided by seed investors, seed series A for product development and market validation, Series B funding, Series C funding and Series D funding for scaling the business progressively. Each funding stage requires groundwork, consultations, and due diligence which creates the need for more specialized effort as time progresses.

Source: https://visible.vc/blog/startup-funding-stages/

The Pre-Seed Stage

Pre-seed investments are usually needed before the latter stages of venture capital begin. The pre-seed investments in pre-seed stages can come from angels, accelerators/incubators, and specialized VC funds. Some of the more popular funds are provided by Hustle Fund, Forum Ventures and Bessemer Venture Partners.

Typically, pre-seed funding rounds range from $100,000 to $5M. Some startups may need less or more, depending on the investor’s interest and the company’s needs. The best way to determine the right funding amount for you is to evaluate your needs, analyze the firm’s burn rate, and analyse with investors and advisors.

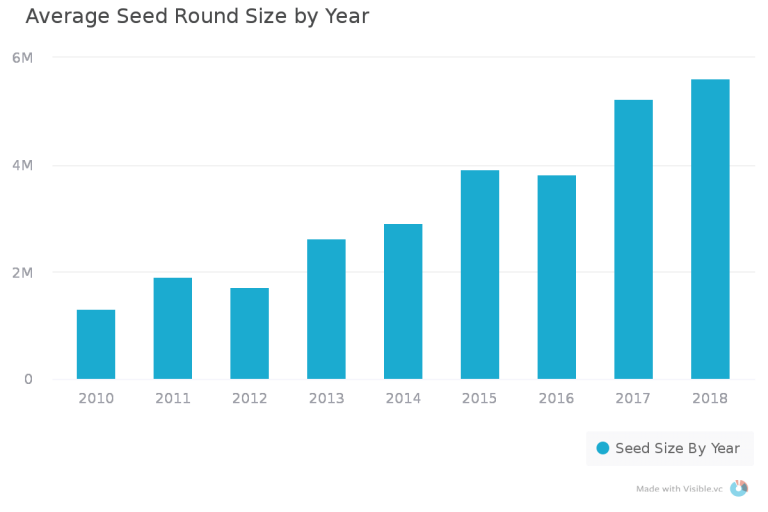

The Seed Stage

Seed investing is the start of the startup funding stages process. They are provided by seed investors such as angel investors, venture capitalists, or seed-stage venture funds and are used to cover the expenses of R&D, product development, and other outlays needed to get the business up and running. Newbie entrepreneurs find it easier if they have access to networks that build the future of their business. If the right investors are around, things become much easier. This is why Marquee Equity gives you direct access to 32,000+ VCs, PEs, Family Offices and Angels to scale your firm. The amounts of seed capital funding vary depending on the industry, the business lifecycle stage, and the investors. Seed investing is thought of as high-risk. Although attractive investments for some HNWIs.

Source: https://visible.vc/blog/startup-funding-stages/

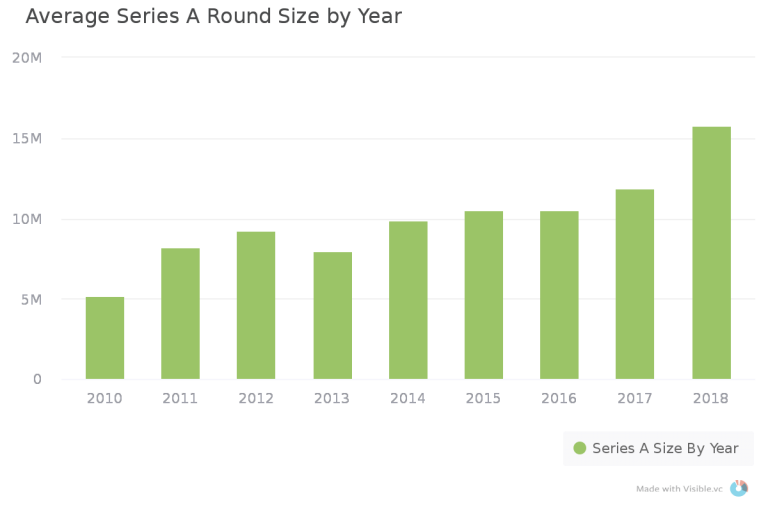

Series A Funding

Seed Series A funding is a stage of venture capital wherein a startup wants to grow and expand its operations and develop its true market potential. Companies at this point in time have proved that their business models work and have strong financials to back that up. In 2022, the median Series A funding totalled $15 million. More of the established VCs participate in Series A funding; companies such as Sequoia Capital, Google Ventures, and Intel Capital.

Source: https://visible.vc/blog/startup-funding-stages/

How to Get Series A Funding:

- By using an Accelerator – One-third of startups that raise Series A funding go through an accelerator.

- By expanding your Network – connecting with investors always helps in the long run.

- Continuing to build on your Network – networking the right way means putting in work to maintain relationships with the stakeholders of your business.

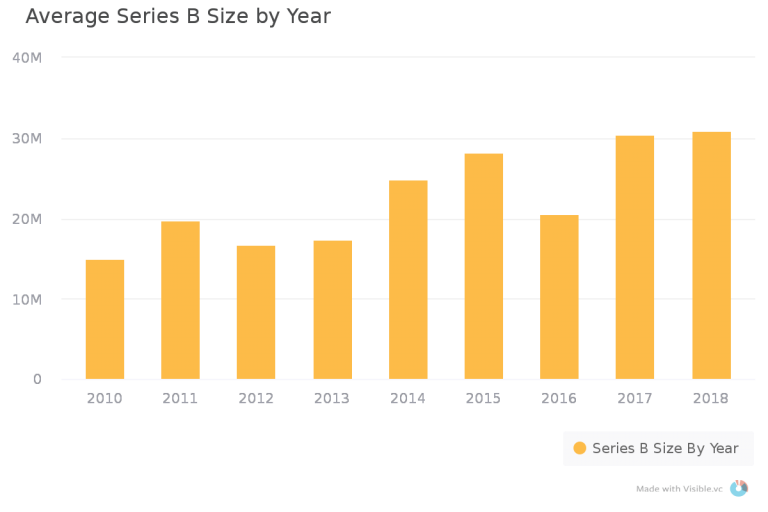

Series B Funding

Series B Funding is the second in a series of funding rounds to help expand and take your company to the next level of success. They are typically the sale of preferred stock to venture capitalists and at this stage of funding, businesses need to boost business development, sales, advertising, tech, support, and talent. Popular firms that make Series B investments are Google Ventures, Kleiner Perkins Caufield & Byers and New Enterprise Associates. In addition to venture capital firms, strategic investors such as large corporations or financial institutions may participate in a Series B funding round. These strategic investors usually bring valuable connections as well as funding.

Source: https://visible.vc/blog/startup-funding-stages/

Series C Funding

Series C Funding is the next round of venture capital funding after Series B. Businesses want to focus on scaling and growing more than ever. Big financial groups like hedge funds, investment banks, and private equity firms are in this funding round such as Accel Partners, Goldman Sachs and Sequoia Capital. There could be incoming requests to invest at this point from investors because the startup has proven itself to be successful and promised more financial success down the line. The average amounts in this stage are $30M to $100M.

Series D Funding

Series D funding might occur if the investments received in Series C weren’t satisfactory. Some companies might opt for this because they weren’t happy with how much they raised at the Series C funding round. Not a lot of firms make it to Series D, or beyond. Series D rounds usually devalue a company which could mean trouble for investors. Costs here are needed to be met because the business might face survival challenges.

Series E Funding

Again, if the previous investment round wasn’t sufficient, another round might be needed. Businesses here usually only need money because it hasn’t been able to make up their own capital back and is fighting to stay private and active.

Series F & G Funding

While still possible, very few companies make it here. Some companies usually raise capital just as a ‘way of doing business’ although it always runs the risk of being diluted more and more. The important thing to understand here is that each series typically comes with new investors with different terms than previous rounds.

Summing It All Up

While this might seem like a lot of funding rounds to go through, know that each business has a different purpose, and along with that, its needs and expenses vary too. There are a lot of companies that need fewer funding rounds to grow and expand as compared to others. As a business owner, you have to ask yourself at which point of the business lifecycle you’re in, where you would like to be next, and what it would take for you to get there. Marquee Equity solves all of your worries by providing the right people and the right resources for your business to succeed. Call +1-213-600-7272 now!

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.