Things to Consider During the Mergers and Acquisitions Phase

A corporate acquisition or merger can carry a massive impact on a company’s long term outlook and growth prospects. But while the

By teammarquee . December 15, 2021

A corporate acquisition or merger can carry a massive impact on a company’s long term outlook and growth prospects. But while the mergers and acquisitions process can change the merged or acquired company overnight, there is also a degree of risk involved.

In this article, we are going to look into the risks associated with the mergers and acquisitions process and key things of consideration during the sale of the company.

Risks Involved in Merger & Acquisitions Process

Financial Risk

Overpayment is one of the most common risks present in M&A situations. The excitement attached with business acquisition mixed with the urgency created by the financial period deadline or vendors tend to build up an impetus to expedite the transaction. This sense of urgency gives less time for the entrepreneurs to work on an agreement which retains or creates value.

Legal & Regulatory Risk

It is crucial to review the businesses’ contracts with their suppliers, customers, partners, landlords, financiers, and the insurers. In addition to that, it is important to assess the regulatory environment for both the companies during the sales and acquisitions process.

The value of a business can be significantly lowered by the loss of a big client, the cancellation of supply of a key input, etc. So do ensure that the contracts are all watertight and non-void depending on any business situation.

Cyber Risk

Cyber and IT risk is a growing risk to mergers and acquisitions. It is a key component of modern-day businesses both on the operational ground and in terms of the flow of information needed to make important decisions. A difference in the systems can lead to a massive amount of effort and can take a very long time to get corrected. In the absence of crucial information available online, it can become difficult for the management to make decisions with complete confidence.

Integration Risk

It is one of the most less talked about risks of a merger and acquisition transaction. A number of integration issues can happen after a M&A, both on the operational and cultural front. Aligning of workforces, operational processes, and the premises takes diligent planning and a dedicated time.

Identifying the synergies before the M&A and creation of a plan for operational and organizational change is important for integrating the businesses. The cruciality of it, makes due diligence a key part of the merger and acquisition strategies.

Now that we have looked into the different risks involved in the merger and acquisition process, let us dive into the key factors to consider when selling a company.

Things to Consider When Selling a Business

The value of merger and acquisition is negotiable

It is crucial for entrepreneurs to understand that the offer and value of their business that another firm quotes, is negotiable. But since the benchmarks are not very clear for the listed companies, there are other ways to look at the M&A Valuation part.

- Market comparables – what is the revenue count that you direct competitors are making, are you growing as fast as your competitor?

- Prices paid for shares by the recent employees

- Recent 409A valuation

- Company’s projected financial growth

- Is your company a potential IPO candidate?

These factors can play a role in deciding the merger and acquisition valuation of your company when you are out to sell your business.

At Marquee, when we were helping a Singapore based AI company raise $1.5 M, or when we helped a UK home care tech company raise €5M, we noted that irrespective of what valuation you think you deserve, you should always negotiate. The buyers rarely put their best offer in the first time, you can negotiate to get more valuation.

Mergers and Acquisitions process can run long but there are things you can do to shorten the timeline

It is not uncommon for the process of merger and acquisition to run 4 to 6 months. The things leading up to this timeline can include seller making efforts to get more bidders interested in the business, buyers spending a lot of time in due diligence, etc.

Now irrespective of what those reasons could be, there are key measures that an entrepreneur can take to shorten the time frame.

- As a seller you should keep all the key material information like financial statements, important contracts, etc. in one place so that you won’t have to look through multiple folders when the d-day is near.

- The CEO of the company should be prepared for the pitch on both the strategic and financial end.

- A lead negotiator, who is experienced in the M&A deals department and who can make quick decisions on behalf of the sellers, should be appointed.

Having multiple bidders can get you the best deal

The greatest deals for the sellers usually happen when there are a number of prospective bidders. By using the competitive situation, the sellers can obtain a high price, great terms of the deals and sometimes even both. Having talks with only one bidder can put the selling company in a lot of disadvantage.

By talking to multiple bidders, every bidder can be stacked against the other to make a favorable deal. Moreover, even the perception that multiple bidders are involved can help speed up the buying process while get the potential buyers to make the best deal.

Making of a definitive acquisition agreement is very crucial

The key to a successful selling of a company is having a well-strategized merger and acquisition agreement in place that is as seller-focused as it can be. Here are some main provisions that should be covered in your acquisition agreement:

- Purchase price and transaction structure

- Milestones for earnouts or contingent purchase price adjustments

- Amount and period of holdback or indemnity escrow for indemnification claims made by the buyer

- The type and extent of warranties and representation.

Managing the seller company’s employees and the benefits they get will become important

One of the key things to consider during an M&A process is what happens to the seller company’s employees. The future of the employees should be clearly mentioned in the acquisition agreement along with the details of the benefits that they will now get (or if it would remain the same).

Here are the employee-related factors that should be noted –

- How will the outstanding stock options and restricted equity be dealt with.

- Will the buyer need the key employees to agree on “re-vesting” their vested options.

- Will acceleration of payouts to management from the deal trigger the excise tax provisions of Internal Revenue Code Section 280G.

- If there is a termination of employment of some of the seller’s employees at the closing, who will bear the severance costs?

These questions when answered in black and white, in addition to playing a role in employee retention, gives employees the confidence that their job is not in danger.

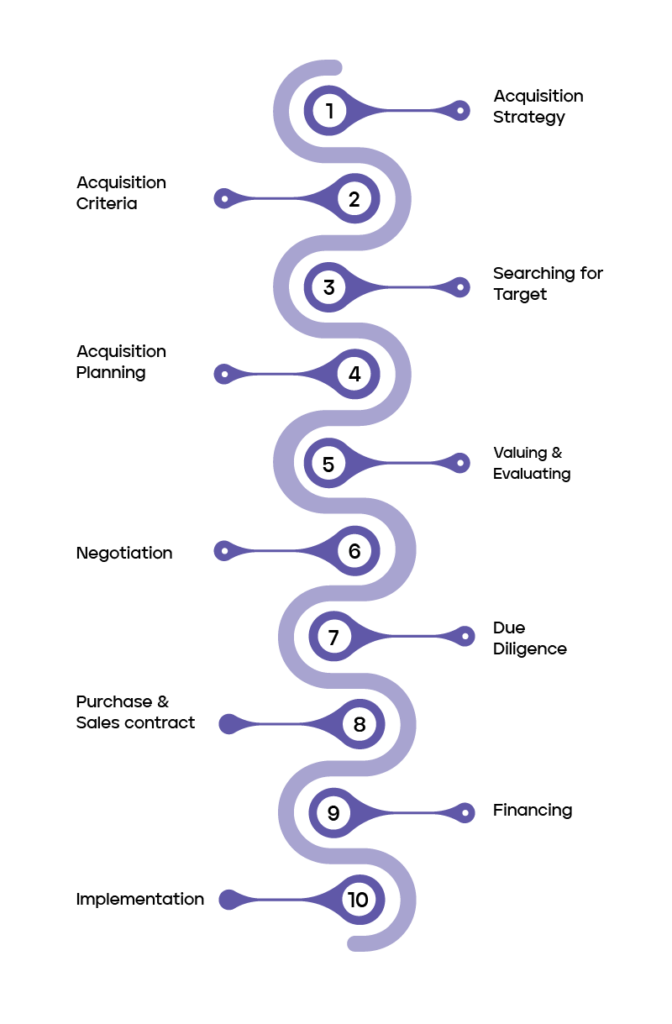

So here were the things that should be considered when selling your business through merger and acquisitions. Taking note of these points and several others which are a part of the M&A deal is a lot easier read than done. At every stage you would require the assistance of a specialized M&A team. They will not just help you get acquainted with the process by explaining the mergers and acquisitions meaning but will also see the process through by working alongside your company.

We can help. Reach out to us to make your selling your business process a smooth sailing one.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.