The startup periodic table

What are startup periodic tables, and more importantly, how can they help you? Find out here.

By teammarquee . February 7, 2023

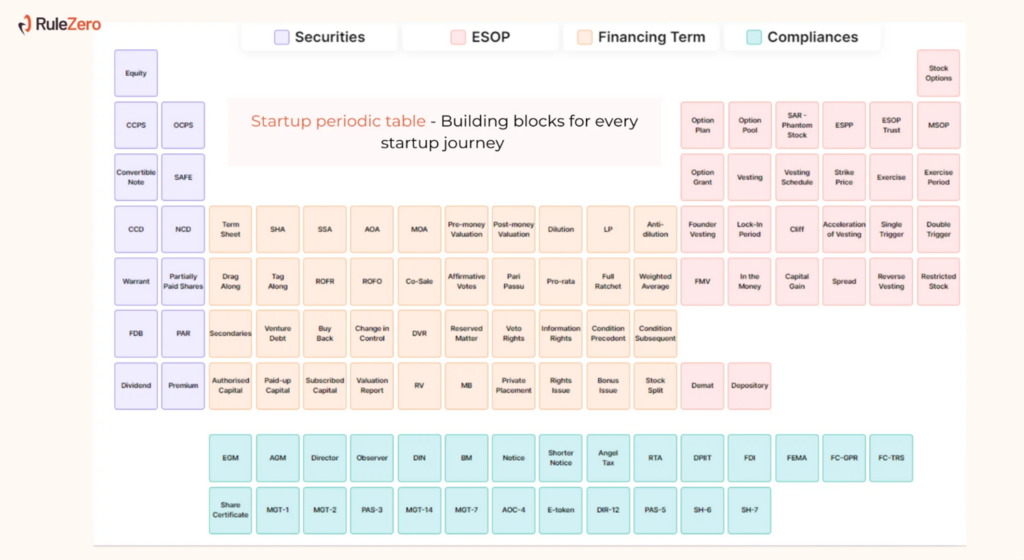

The Startup Periodic Table is an illustration that sorts different stages and fundamentals of a start-up company‘s growth and development. The periodic table also helps to understand the challenges faced by a start-up business at each stage, and what start-up funding and skills are required to make business startup ideas successful. The Startup Periodic Table is arranged in a table format with the stages of a start-up‘s building blocks for a start-up’s journey.

The periodic table categories:

Securities:

Investopedia defines this term as a fungible, negotiable financial instrument that holds some type of monetary value. Security can denote ownership in the form of stock, a creditor relationship with a legislative body or a business represented by owning that entity’s bond; or rights to ownership as represented by an option. They help a start-up company’s founders to gain insights into the various kinds of securities they can issue and what securities are ideal. While the periodic table shows different types of securities, broadly they fall into a few categories, mainly;

Equity Securities

Equity security is an ownership interest held by shareholders in a company, partnership, or trust), realized in the form of shares of capital stock, which includes common and preferred stock.

Debt Securities

This is borrowed money that has to be repaid, with the terms of the contract signed. This would include the size of the loan, interest rate, and maturity or renewal date.

Hybrid Securities

They combine some of the characteristics of both debt and equity securities. Example: Equity warrants.

Derivative Securities

A financial contract whose price is determined by the value of an underlying asset, such as a stock, bond, or commodity.

Asset-Backed Securities

An asset-backed security is part of a larger basket of similar assets; loans, leases, credit card debts, mortgages, or anything that generates income.

ESOP

An employee stock ownership plan is an employee benefit plan that gives workers ownership interest in the company in the form of stock. Understanding this is helpful for start-up business founders because they have tax benefits, and are used as a corporate finance strategy to align vision across the company.

Financing Terms

By financially educating yourself a bit, you can safeguard your startup business ideas

by simply being able to identify what are the available options and how to differentiate them. Here are some of them:

Stock Option

A stock option gives an investor the right, but not the obligation, to buy or sell a stock at an agreed-upon price and date.

Restricted Stock

The stock of a company is not fully transferable until certain conditions have been met. Once met, the stock is no longer restricted, and becomes transferable.

Lock-in Period

A period of time when investors aren’t allowed to redeem or sell shares of an

investment.

Compliances

Knowing your way around legal restrictions is crucial for long-term success. Hiring a good legal team will always help you down the line; they help avoid delays, loss of reputation of the business, and save penalties. For an investor to invest in startups, the company he’s invested in must be thorough, legally speaking. Start-up funding is provided only when a company is well within its legal boundaries. Make sure you stay in sync with the current regulations in your district.

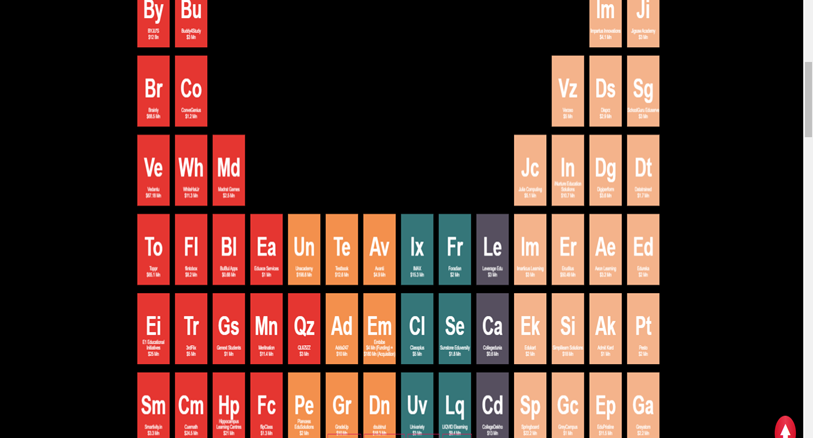

The Periodic Table Of India’s Edtech Startups

While the periodic table might show the fundamentals of the core runnings of a startup, it can also be used differently. See above.

This table shows the Periodic Table Of India’s Edtech Startups. The tiles include the name of the company, city and the funds raised.

Multiple high-profile funding rounds have been raised for BYJU’s, Vedantu, embibe, Toppr, Testbook, Unacademy and others in the past. For investors to invest in startups, the outlook is more bullish on the ed-tech market. Between 2014 and 2019, a total of $1.8 Bn was raised by ed-tech startups across 303 deals as per data recorded by DataLabs by Inc42. Bengaluru leads hub-wise trends with 58 firms. Delhi NCR follows with 16 startups in the periodic table, with Mumbai’s 11 startups in third place.

Uses of a Start-up Periodic Table For Investors

Depending on the type of table in question, a startup periodic table can be used for:

- Understanding the different types of startups and their key characteristics.

- Identifying areas for innovation and disruption.

- Categorizing startups based on industry, business model, and stage of development.

- Providing a visual depiction of the startup ecosystem.

Uses of a Start-up Periodic Table for Entrepreneurs

- To understand the different stages of a startup: It shows the journey of business startup ideas. This helps entrepreneurs understand what to focus on next.

- Tasks prioritization: By knowing what stage they are in, entrepreneurs can order tasks and apportion resources effectually.

- Measure progress: The periodic table provides a way to track progress and identify areas that need improvement.

- To identify potential partners: The periodic table can help entrepreneurs find partners who have complementary skills.

- To identify potential investors: The periodic table can also help entrepreneurs identify potential investors who are looking to invest in startups.

- Shows industrial environment: The periodic table offers a wide-ranging view of the startup ecosystem and helps generalize the outlook.

Parting Words

The Startup Periodic Table serves as an advantageous tool for entrepreneurs and investors in understanding the different rudiments of a successful startup. From the product, market, and other departments, each element plays a role in the overall success of a startup. By considering these elements and evaluating them judiciously, entrepreneurs and investors can make informed choices and maximize their potential for success. Finally, the start-up periodic table is a valuable resource for anyone looking to launch or invest in a start-up and a useful reminder that every successful start-up is built on a solid foundation of well-developed elements.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.