Revolutionize your deal strategies & flow process with our deal origination services

Our deal origination experts update the deal pipeline for funds, pitch buyers, generate leads and manage relationships with intermediaries.

Our Deal Origination Process

Our deal origination firm makes sure that you don’t miss out on any deal that is worth investing in.

Target Research

We define a niche market relevant to you and identify the prospects. This step is essential in order to perform the initial market research to verify the feasibility of the investment thesis.

Monitoring

Screening the target list is very important. We look out for any critical changes or other trigger events and keep you posted at all times. Investment advisors track growth, capital needs, M&A maturity, etc and advise you accordingly.

Outreach campaigns

In order to convert prospects into legitimate leads, we enforce outreach campaigns. Through these email campaigns we gather data, gauge interest level and develop a good relationship with prospective acquisitions.

Calendar and email Management

It takes an infinite number of emails, phone calls and meetings to source a deal successfully. We allocate a deal origination specialist who puts in business development efforts consistently for you.

Analyzing the strategy

Our goal is to improve your investment returns by managing deal sourcing. So, we rely on data and analysis. After research, valuation and vetting processes, suitable deals are sent your way with clear strategies.

Performance measuring

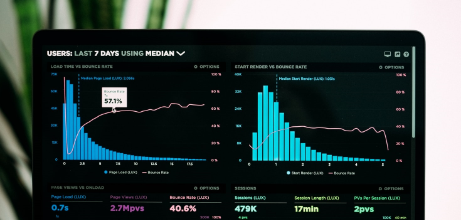

In order to provide an effective and efficient deal sourcing process, we maintain track and measure different KPIs and provide progress updates to you.

Our Deal Origination Strategies

Having a strategy for deal Sourcing, is the first and the most important step. Through deal origination firms pitch potential buyers for mergers and acquisition, raising capital, debt financing, etc.

Deep targeting

All you have to do is define your criteria and set your budget. We curate deal sourcing strategies as per your requirement.

Filtered targets

We provide filters to make your life easier, the filter includes - general lists plus specific whitelists to focus on. Not only this but also, blacklists of prospects to exclude that are not the best fit for you.

Email API integration

You can now choose to make your emails and messages appear as if they have been personalized and sent directly by you using API. This shows how interested you are and helps build a good relationship with the prospects.

Machine learning powered technology

Prospect engagement is of utmost importance to us when it comes to deal origination. We use email sequences, auto follow ups and auto detection to contact the companies in case of no response.

Most Popular Deal Sourcing Strategies

There are two most popular deal sourcing strategies across the market, one is in-house and other one is on a contract or assignment basis.

In-House Deal Sourcing

Firms employ a dedicated deal sourcing team which includes experienced finance professionals who have extensive knowledge about deal origination plus a wide network of contacts. This team works on a full-time basis for the firm.

Deal Sourcing Specialist on Contract/Assignment Basis

These are specialized firms or individuals who work as consultants and their main job is to work with Investment Banks in sourcing clients and are usually paid on contract basis.

Traditional VS Online Deal Origination

There are two main approaches to deal origination, namely - traditional approach and online deal origination.

Traditional Approach

Many investment firms rely on the traditional approach to source new investment opportunities. This approach is highly dependent on the firm’s broad network that includes contacts and referrals.

Online Deal Origination Approach

This is the latest technique of deal sourcing, although some firms still go for the traditional approach but this is more popular among mergers and acquisitions firms. Financial technology firms provide deal sourcing platforms that are used to generate new leads and to reach out to a broad audience.

Deal Origination Using Technology and Media

Online deal sourcing has made the deal origination process easier and efficient. The online platforms help the buyers and sellers meet virtually which in turn increases leads. These platforms also provide a customised experience to the users by researching and listing deals and maintain a record of all transactions between the users, which enables them to view the transaction history before closing a deal.

Our Expertise

Our deal origination team scans the market to bring in the best deals as per your investment goals.

Our data, technology and analysts deliver inbound deal flow

Fully Managed service with 12 hour response from our deal origination experts

Improve the quantity and quality of your deal flow without increasing your costs

Customised pricing plans, pay on a per outreach or per targeted deal originated basis

Pitch calibration support - sample pitches, call to action, follow up pitches

We deliver 50 to 600 prospect engagements on each mandate, depending on the outreach plan one chooses.

FAQs

Our Trustpilot Reviews

Rated Highly on Trustpilot