Short-term and Long-term financing: A pocket guide for businesses

A company, especially one at a growing stage, requires funds. It could be to get help with hiring activities, to buy inventory,

By teammarquee . February 8, 2022

A company, especially one at a growing stage, requires funds. It could be to get help with hiring activities, to buy inventory, to rent out an office in a prime location, the reasons can be endless. However, unlike the reasons to seek funding, the ways to get finances are not so extensive in nature. For a business not going for the typical investor funding route, they only have two options to choose from to meet their unplanned and planned expenses – short-term and long-term financing.

In this article, we are going to look into the different facets of long term financing and short term financing along with the options available in both.

What is short-term business financing?

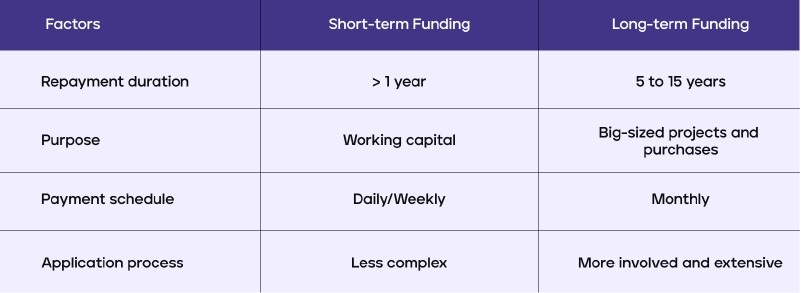

Short term business funding can be defined as any finance model that is paid off over a very short repayment time. On a more specific level, it is usually a financing option that a business has to pay off in 12-18 months of time.

Short term funding for business comes with some specific characteristics like quick funding, easy qualification process, lower cost of capital, etc.

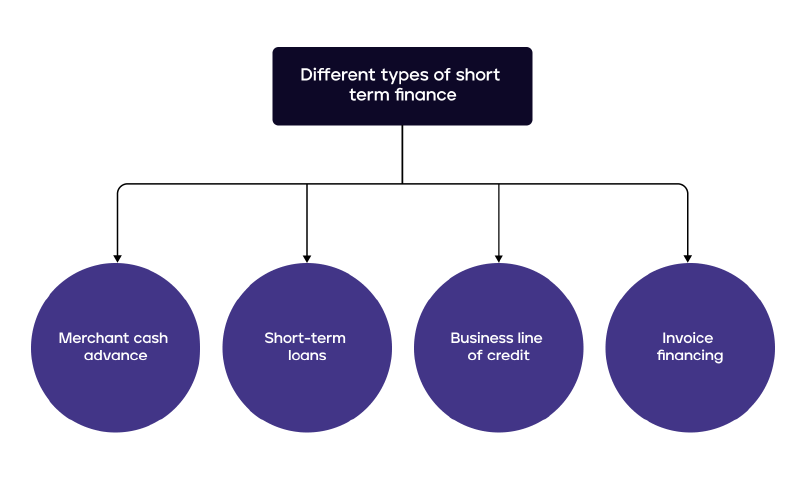

What are the different types of short term finance?

When we talk about business funding, short-term is considered the best option for businesses, mostly on the back of the fact that they are easy to get. Here are some of the options available to businesses.

Merchant cash advance: Merchant cash advances are a lump sum amount which is repaid directly through the debit and credit card sales. The financing company here takes a part of the sales and the fees, usually on a daily basis. In this financing model, it can range from 4 months to 18 months.

Short-term loans: These are very similar to your typical loan system. You get a lump sum capital which you have to repay in installment form in a fixed time period. In this case, the time period ranges from 3 months to 18 months.

Business line of credit: It works very similar to credit cards. When you qualify for the business line of credit, you get access to credit from which you can pull out the working capital. And just like credit cards, you will have to pay back the money you have spent plus the interest.

Invoice financing: The business funding model provides you an advance for the outstanding invoice payments which your business is waiting for the customers to pay. Since the outstanding invoices act as a collateral, you are able to secure an advance affordably at a fees of 3+1% paid weekly.

What are the benefits of short term business funding?

- Quick working capital

- Easy to qualify for

- Low cost of capital

What are the disadvantages of short term financing?

- More expensive in the repayment period

- Shorter payment duration

- More frequent payments

When should you get short term business funding?

As you must have gathered till now, there is a wide range of benefits that come attached with short-term financing models. But what cannot be ignored is the fact that it can be expensive and pressure-giving for startups. There are several instances where getting short-term funds makes sense, such as –

When there’s a sudden interruption in the cash flow – If your business faces some seasonal slowdowns or short-term cash flow issues, you can opt for the model.

Short term opportunity – If your business finds a lucrative opportunity but needs funds to make it happen quickly, you should go with the option.

In cases of emergency – If your business comes across some emergency fund requirement, like for example towards fleet repairs or building issues, short-term models can be a savior for you.

Now that we have looked into the different aspects of short term business funding, it is time to get into the long term business funding part.

What is long term funding for business?

Long term business funding can be defined as any finance model that is paid off over a good enough repayment time. On a more specific level, it is usually a financing option where the business has to pay off the amount in more than five years time.

Usually, because there is a higher amount of risks involved with long-term funding, lenders tend to ask for greater substantial assets and a higher cash flow before giving money to the businesses.

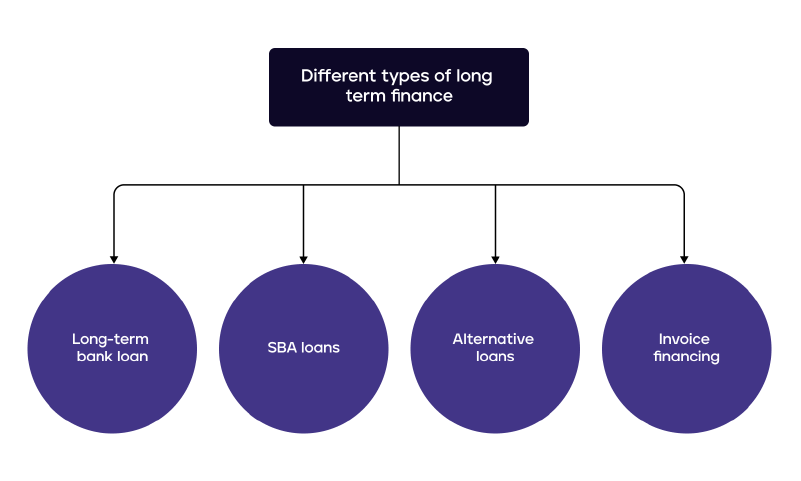

What are the different types of long term finance?

Although slightly difficult to get compared to short term business funding, long term finances tend to help businesses in their plans that go beyond 3 years. Here are some of the options available to entrepreneurs to choose from.

Long-term bank loan: These are usually the first long-term financing options that entrepreneurs choose to opt for. While it has a long list of terms and amortizations, it is generally considered the most stress-free options.

SBA loans: The Small Business Administration loan is a financing type which offers businesses bank-rate facilities to businesses. These loans are usually used for acquisition, purchasing real estate, consolidating the business debt, etc.

Alternative loans: These are the loans offered by private lenders, fintech lenders, and commercial lenders. They are a decent option for businesses looking for financing seeking capital for a time period of 5 years. While the rates are comparatively higher, these are comparatively easier to get as opposed to other models.

What are the benefits of long term business funding?

- Greater repayment time period

- Lower rate of interest

What are the disadvantages of long term financing?

- Need to have collateral

- Greater accumulated interest value

When should you get long term business funding?

As you must have gathered till now, there are good enough reasons why you should opt for long-term financing, but what cannot be ignored is the increase in time when you get married with the repayment terms. As an answer to this dilemma, let us look into the instances where getting long-term funds makes sense –

In case of business acquisitions – The intent of buying another business is the number one reason why you would want to get long-term financing support. Since the amount you can get is fairly high and so is the repayment time period, it will be easier on you to acquire a new business and repay with profits.

Commercial real estate purchase – If you are looking to buy your own real estate for your office, it will always be financially viable to invest in a model which can be repaid over a long period of time. This is where long term financing options like bank loans or SBA loans comes in handy.

Equipment purchase or lease – Working with updated machinery and technology is the key to getting a competitive edge. And the way a small business can afford to be in-trend is through the route of long-term funding.

While the importance of funding was always clear, we have now looked into the two funding models that an entrepreneur can choose from. Although, you would have gotten an idea of which one would suit your needs, let us summarize it for you here.

So here were the different aspects of short-term and long-term financing options available to an entrepreneur. Now that we have looked into what they stand for, which should be used when, and what are the different sources of getting financed, it’s time for the next step. And that would be to delve in further to understand the next best move. We are here to help with that. Get in touch with the Marquee team to explain your financing needs and brainstorm the next moves. We can even help you get funded!

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.