The Basics of Raising Capital for a Startup

As an entrepreneur you can understand how difficult raising capital for business can be. Having an out of the box idea for your startup is not enough, raising capital is the key to kickstart your business.

By teammarquee . April 29, 2022

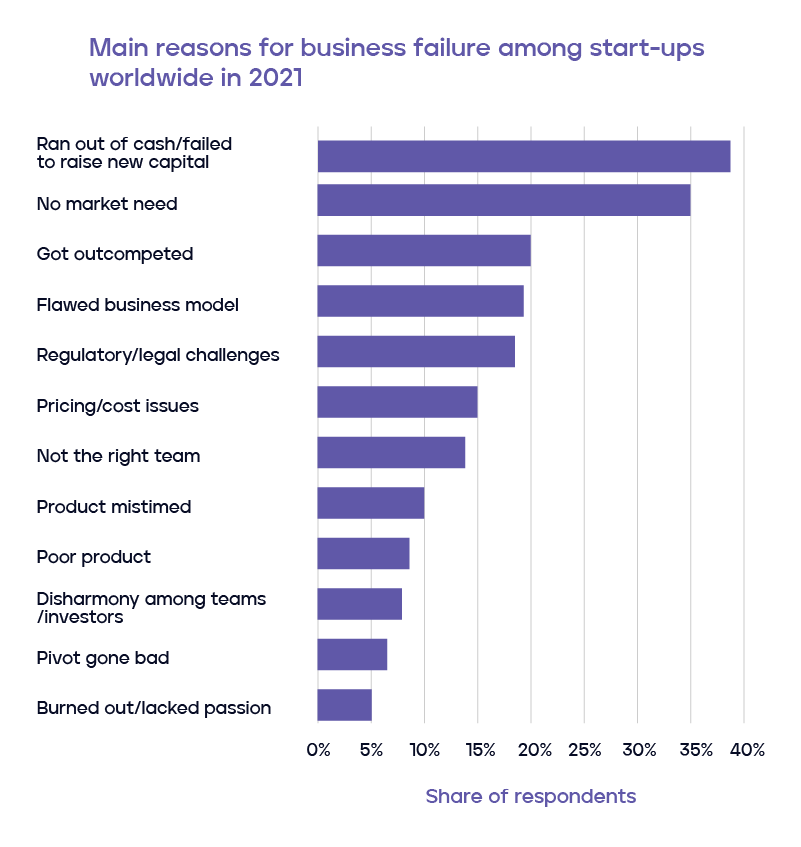

All businesses run on capital. If you run out of funds or do not have additional resources to back you up, you might end up losing your dream. Let me walk you through a survey that will help you understand the importance of raising capital.

CB Insights conducted a survey and came up with 12 reasons for startup failure. They analyzed 110+ startup failures and reached a conclusion that says – 38% of startups fail because, either they run out of cash or they fail to raise new capital. Also, 15% of startups face pricing or costing issues.

There is no denying the fact that money and time are finite and we need to allocate them judiciously. For the startups on the list of the survey, running out of cash is tied closely with the inability to secure financing or investor interest. This was the top reason startups cited for their failure.

While raising capital, it is of utmost importance to have a defined plan that you must follow, otherwise you will end up wasting precious time. Having said that, it is critical to learn the basics of raising business capital.

What Are The Basics Of Raising Capital?

If you have a clear path in front of you, the distance between where your business is right now and where you want it to be can be shortened. Below mentioned are a few tips and tricks that you can follow while raising capital for startup:

1. Prepare yourself for the capital raising process

The basic step you need to accomplish while raising capital for business is being aware that your startup needs funding. During this step, you will have to address various aspects of your business.

However, being aware won’t be enough, you will have to do an immense amount of research regarding the industry your startup will operate in, its competitors, state of the market, your team’s performance and the key players. Knowing your finances will be vital – projections, balance sheets, cash flow statements, deciding the mode of raising capital – debt or equity.

Now that you have worked on ground zero and understand your business better, it will give you an edge when you reach out to the investors and you will be able to do justice to the questions they might ask.

2. Keep your pitch deck ready

The success of getting startup investment funds depends entirely on the pitch deck you present to the prospective investors. The more convincing and driven it is, the higher would be the chances of you sealing the deal. At Marquee, we have a team that specializes in the creation of pitch decks. There are three factors that you have to include in your pitch deck:

- Show that you know the market: The deck should have the size of the target market, the problem that the market is facing and how your product will be the magic solution. Be very specific while explaining how the existing solution providers are not able to solve the issue and how your product or service stands out.

- Know your finances: As an entrepreneur you should know what area is making you money and at what cost and which areas are taking up your working capital but not doing you any good. You should also know how much money you need while raising funds for startup. Don’t forget to back your words with data based business projections.

- Focus on investor’s gains: In addition to giving business models, acquiring and expanding business plans and plans to go public, etc, don’t forget to add their role in every stage. Also, mention an exit strategy for the investors and tell them what they will leave the table with if the business fails to succeed.

3. Use your network and seek for potential investors

I am sure you must have heard the famous phrase that a little kindness goes a long way. If you are helping other people, you will have a positive reputation. Also, when you help others grow they are more likely to help you at the time of need. So, it is not necessary for you to keep promoting your business every time, you can work on your networking skills.

Make sure that you exhaust all the methods of raising capital. Keep in mind that there is a huge possibility that you might face a lot of rejection in the startup fundraising process because sometimes investors are not looking for opportunities or maybe your idea won’t be a great fit for them. So, my suggestion here is to do your research on various investment groups and resources online that can prove to be worth your time.

Once you understand the basics of the fundraising for your startup, you should have a clear understanding of the startup funding stages. Don’t worry, we got you covered, continue reading!

What Are The Startup Funding Stages?

Seed Capital

Seed stage funding is an early investment stage. Seed money sources include the bank of family and friends, crowdfunding for startups and personal savings. Investors often get equity stake in exchange for the seed capital they invested.

Angel Investor Funding

With time, your business will grow and more funding will be required for product development, marketing and team expansion. Angel investors are individuals who invest in promising startup companies in exchange for a piece of the business, usually in the form of equity or royalties.

Venture Capital Financing

At this stage, you would want to scale your startup to new business channels, segments and increase marketing efforts to expand your target audience. Venture capitalists are very particular about their investments since they want a good return on investment for their clients.

Mezzanine Financing & Bridge Loans

Funds raised at this point will be geared towards expansion to new markets, mergers, acquisitions and preparing for IPO. A clear roadmap to a profitable business is what the investors want to see now. For example, mezzanine financing can cover the expenses of an IPO. Further, the mezzanine investor is paid back with interest gained through the profits made from the IPO.

Initial Public Offering

Once a company goes public (by listing on a stock exchange), shareholders (founder, employees and investors) can monetize their ownership of the company by selling their shares on the stock market. In addition to access more capital, IPOs help companies find exits for their shareholders.

Now that you are crystal clear about the basics of raising capital and the stages involved for startup funding, we suggest you should go ahead and start doing your research.

Final Words

The above mentioned facets together can help understand how to raise capital for a startup. The basic factors involved in the process along with the stages of raising capital for your brand will guide you to strategically present your brand to the investors.

But note that with this, we have barely scratched the surface. There is still a lot to know about how fundraising works, where to find investors, how to create a pitch that is impossible to get turned down, etc. So, feel free to reach out to us, if you need any funding support for your business.

We optimize & accelerate growth for already great products.

Valuation Practices for New-Age, Pre-Revenue and Early-Stage Companies

Valuation is often perceived as a mechanical exercise—an output generated by spreadsheets, formulas, and forecasting templates. While this perception may hold partial validity for mature companies with stable operations and predictable cash flows.