How to de-risk a startup to become investment-friendly?

De-risking a startup is what new entrepreneurs need to launch a successful business right off the ground. Moreover, it helps them get closer to getting startup funding. With over 90% of startups failing in a few years after their launch, de-risking is something that can help lower this percentage.

By teammarquee . February 23, 2022

Whenever someone mentions startups or growing their own business, they are met with the notorious statistic of how 90% of startups fail with only 50% going beyond the first five years of existence. Now while these statistics are very scary, let’s be honest. Quitting your day job to become an entrepreneur is a scary task.

But for a want-entrepreneur, it is important to remember what made them want to be an entrepreneur in the first place. It was the calling of leaving their day jobs and building something from the ground up. So, the one way for the future entrepreneurs would be to make a fool-proof business plan. Doing this won’t just help them build a successful business but also bring them on the path of getting startup funding.

In this article, we are going to look into every individual factor that goes into a de risking business model and making businesses investment-friendly.

What is the de-risk business meaning?

Every business journey comes with its share of risks and failure instances. The de-risk business model is an approach where you plan out all the probable risks and pitfalls that can lead to the business failure. On the basis of this knowledge, entrepreneurs work towards creating a risk-free business, right from the scratch.

So now that we have looked into what is de risking in business, the next step would be to understand the risks of starting a business and their workarounds.

How to de-risk a business?

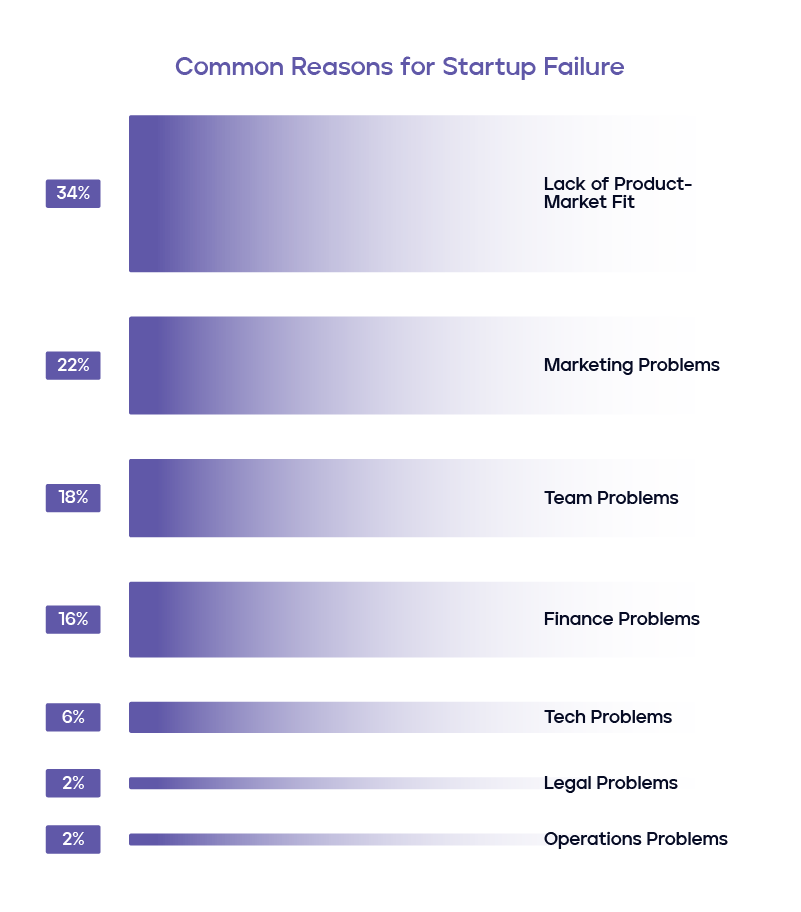

Let us take a detailed look into the kind of risks a startup generally faces and the different ways first-time entrepreneurs avoid them before they think about scaling their business or look for startup funding.

Unclarity of product goals

According to a CBInsights report, 42% of startups fail because of a lack of market need for their offering.

Having an amazing idea is a perfect thing. But having an idea that provides true value to the customers. You need to get answers to questions around –

- What is the product?

- What is the problem which it solves?

- How do you sell the product to the customers?

Answers to these questions can help build the perfect product idea. The solution to this would also lie in doing an extensive set of research around knowing what the market truly needs and how your product can address it.

Growing too slowly or too fast

Fast growth is something the investors and entrepreneurs want to see, but when you move too fast you might risk it all because of the bad timing and slow market demand.

On the other hand, slow growth can lead to businesses losing out to their competitions.

Growing too speedily or too slowly can cost businesses money, create some conflicts in a team, and lower the quality of your product or service.

The secret to a healthy startup growth can be traced by looking at your metrics and data. Now, rather than making unrealistic goals in a way to reach growth faster, make real growth and financial prediction on the basis of the early development signs.

Burnout

One of the most common startup business risks lies in burnout. They are usually made of smaller team sizes which makes people wear multiple hats. What this leads to is startups burning themselves out and the teams getting overextended.

What is important for entrepreneurs and teams to maintain a proper work-life balance and take time off. Only when you work according to plan and milestones while taking regular breaks, will you be able to go far in your entrepreneurial journey.

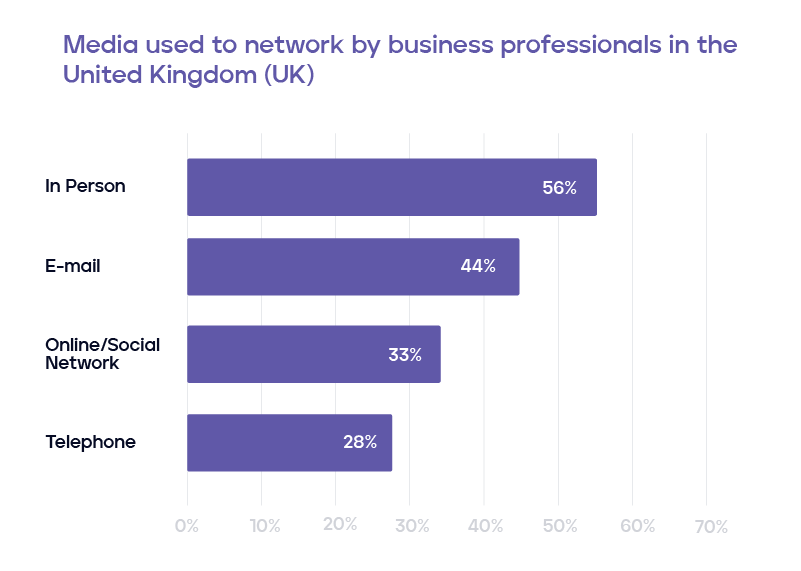

Lack of mentorship

Companies which get several rounds of VC fundings get access to mentorship as well from both their investors and the business ecosystem. For the startups, this can get challenging.

The solution to this lies in networking. The more entrepreneurs network, the bigger would be the chances of them finding a community of supporters. If you are unable to find people in your closed circle, you can reach out to seasoned entrepreneurs on LinkedIn and even offline communities.

Absence of the right team

Having the right team by the side is the secret of a business’s success. However, hiring the best team comes with its own set of risks and challenges, especially for startups.

The problem that entrepreneurs face when it comes to hiring is that they end up spending their time in all – managing their business growth, being involved in hiring activities, and being a mentor.

However, for business success it is important that you hire the best people who don’t just have the necessary skills but also have the best culture fit. What would be best when it comes to eliminating this startup risk, is hiring people who have multiple skill sets and are in many ways the jack of all trades.

Lack of funding

Irrespective of how innovative or truly valuable your product is, one of the biggest risks of starting a business is running out of funds. A majority of the small businesses get seed funding from family and friends but there are also entrepreneurs who don’t have any funds to start with.

While there would be some time to get to the funding stage, it is important for businesses to have clarity in the financial forecast and department wise budgeting. If possible, hire an in-house accountant who would help you budget your revenue and plan the expenses better.

So here were the risks associated with startup growth and the solutions that help de-risk them bringing businesses closer to getting startup funding. For a new entrepreneur charting all this can be difficult. In case you need any help with knowing the process of how to de risk a startup, reach out to the Marquee team.

We have helped over 1000+ startups scale their businesses and get funded. We can help you too. Talk to us today.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.