What’s The Difference Between Angel Investors and Venture Capitalists?

While raising capital via angel investment or venture funding, startups receive financial aid in exchange for equity and may have to forsake some company operational control. Check out the 2022 Guide to Investment with angel investors vs venture capitalists to know which financing model suits your business needs.

By teammarquee . May 23, 2022

Angel investors are typically affluent individuals who invest their money into your business idea without taking too much operational control. In contrast, venture capitalists invest other people’s money and get a higher equity stake in the company. Since a risk capital company employs venture capitalists, they can invest more money into your business than angel investors.

Raising capital from different types of investors in startups is no walk in the park, especially if the entrepreneur doesn’t know who to target for their business’s capital and operational needs. While there are no hard-and-fast rules applicable to angel investors and venture capitalists, the financing from angel investors vs venture capitalists can include intricate differences. These can vary in the number of investors involved, equity holding, the capital amount, and even the nature of the investment from the capital source.

In this blog, you’ll be educating yourself on key differences between angel investors vs venture capitalists, including features, advantages, and different types.

What are Angel Investors?

Have you ever watched the show Shark Tank? The panel of entrepreneurs, the Sharks that approve business pitches, offer them money, and negotiate over equity percentile, are essentially what you call angel investors in the business community.

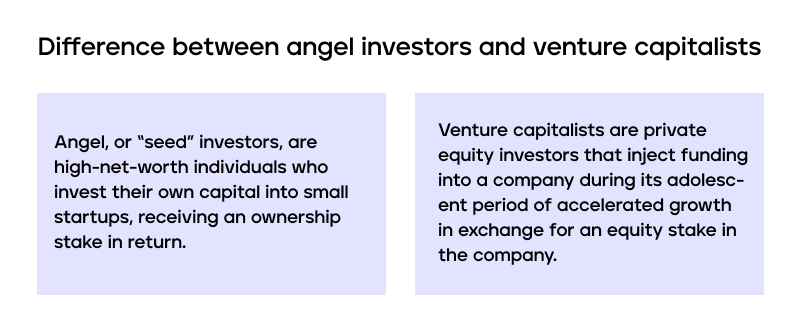

So what is angel capital? Angel, or “seed” investors, are high-net-worth individuals who invest their own capital into small startups, receiving an ownership stake in return. Angel investors for startups may offer a one-time investment or provide an ongoing fiscal injection to pull the business through its difficult early stages.

Since its private funding, there are various types of angel investors entrepreneurs meet when raising capital for their business. However, it’s better to choose accredited angel investors for startup funding as they meet all criteria set forth by the Securities and Exchange Commission (SEC).

What is a Venture Capitalist?

Venture capitalists are private equity investors that inject funding into a company during its adolescent period of accelerated growth in exchange for an equity stake in the company.

A key feature of venture capital is that VC funding is not long-term. Venture capitalists will help nurture the business for seven to ten years by investing in the company’s balance sheet and infrastructure until the business is profitable enough to provide liquidity when launched in the institutional public equity markets.

Although structurally similar to its late 1970s and early 1980s predecessors, where VC funding was limited to seven to ten years, venture capitalists today are ten times larger, with each general partner managing two to five times the investments. So, how does VC funding work in the current economic landscape?

Most trustworthy types of venture capital that partner with venture capitalists are typically big financial institutions such as insurance companies, pension funds, financial corporations, and university endowments—all of which expect a yearly return of between 25% and 35% over the lifetime of the investment.

Advantages of Venture Capitalists

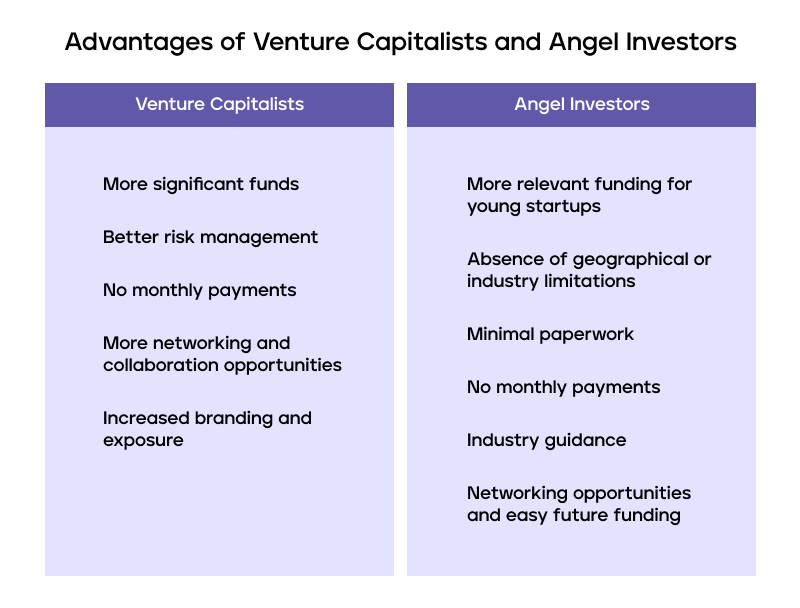

Within the angel investor vs venture capitalist conundrum, entrepreneurs seeking capital should first acquaint themselves with the funding dynamic of both angel investors and venture capitalists and their advantages. So without further ado, here’s a list of top five advantages of venture capitalists to consider:

- More significant funds: Entrepreneurs can raise upto $100,000 for the seed stage of their business and more than $25 million at more mature stages.

- Better risk management: VC funding requires businesses to include a formal reporting structure and board of directors, and while that may sound cumbersome, with an experienced team overseeing company growth and operations, startups can reduce the odds of making a big mistake.

- No monthly payments: Since venture capitalists invest in a business in exchange for private equity, entrepreneurs have spare capital to reinvest in their business since they don’t have to pay a monthly installment or interest.

- More networking and collaboration opportunities: When you onboard a venture capitalist, your business gets several added benefits such as the expertise of the venture capital firm, introductions to firm partners, other startup founders who have received funding, and industry experts from both of their networks.

- Increased branding and exposure: Bagging VC funding is public proof of credibility for any business. Since most VC firms have a thriving PR team and media contacts, while VCs spend up to 50% of their time networking to promote the companies they invest in, having a partner venture capitalist is especially beneficial for founders building their first company. The exposure is also crucial in raising future funding rounds for mature startups.

But if venture capital offers such enviable benefits, why do startups flock to angel investors for funding? The reason is rather simple; venture capitalists invest in industries, whereas angel investors invest in innovation.

Advantages of Angel Investors

Angel investment is private money from a fellow entrepreneur willing to take a bet on your business. To understand better why most startups seek angel investment instead of VC funding in the early stages of business development, here’s a list of 5 advantages of angel investors to consider:

- More relevant funding for young startups: Whether the entrepreneur cannot get a small business loan or the business is in a higher-risk industry, angel investors make excellent backers for promising startups.

- Absence of geographical or industry limitations: A startup can bag millions of capital from an angel investor despite operating from a small town or high-risk industry. While angel investors do take private equity, they do not interfere in the company’s operations unless required or requested.

- Minimal paperwork: Because angel funding is less formal and more flexible than VC funding, entrepreneurs don’t require a lot of paperwork to close an angel investment. Angel investors usually use a convertible note- a lending agreement for short-term debt with interest or discount rate, a valuation cap, and maturity date – to finalize the investment with the entrepreneur seeking capital.

- No monthly payments: Since angel funding isn’t a loan but equity-based financing, the entrepreneur doesn’t need to pay any monthly installment as interest, allowing them to invest all the borrowed capital into growing the company.

- Industry guidance: Angel investors, especially those credited by the Securities and Exchange Commission (SEC), are typically high-net-worth individuals with decades of experience in running a successful business. Having a partner angel investor from the same industry as your business can help you avoid beginner pitfalls and employ high-growth strategies right away.

- Networking opportunities and easy future funding: Because future funding rounds of your business are equally beneficial to the angel investors, they can help you form strategic partnerships in the industry, expedite growth rate, and lead to acquisition.

All in all, when picking the more viable option, entrepreneurs shouldn’t limit their criteria to investment amount alone but also look at the entrepreneurial expertise of the investment partner and introductions to potential future investment partners.

Final Thoughts

By now, you know that the debate between angel investors vs venture capitalists is less about the money and more about the business model. If an entrepreneur is starting out, angel investors for startups would be easier to onboard than a venture capitalist simply because VC firms don’t engage in high-risk investments. Whereas, if the company has shown a high growth rate and the entrepreneur is aiming for a stock launch or an IPO, a venture capitalist is better suited for your business needs.

However, it’s important to note that both venture capital and angel funding carry their own disadvantages and challenges. Angel investors come readily accessible but negotiating a deal agreement can be complicated, sometimes only leading to a verbal back-and-forth without a finalized agreement.

All in all, remember that giving away equity in your company means you have lesser decision-making power. So, whether you opt for an angel investor or onboard venture capitalists, discuss your hopes and doubts with your financial and legal advisors before saying yes to the investment.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.