Entrepreneur Guide on Cap Table

Stay on top of your business with the help of this Cap Table Guide...

By teammarquee . January 6, 2023

A cap table, or capitalization table, is a table that shows ownership stakes in the business (i.e., your stocks, options, warrants, etc.), how much investors paid for them and the percentage of ownership it bought them. They are important in keeping track of ‘who owns how much of what.’ So, what information does a capitalization table keep a track of? Namely; stock ownership as well as convertible securities, warrants and options, and stock compensation grants. This is an instruction manual to know everything about a cap table; it includes a capitalization table example, how to make one, and an understanding of basic cap table management. Before we proceed though, it’s crucial to know that your cap table isn’t just one-time, but something you tweak habitually.

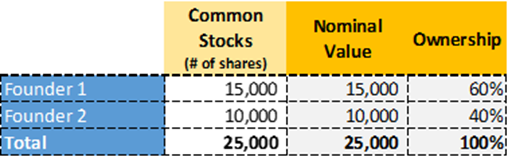

Early Cap Table

This is before you receive financing for shares. It’s very basic and shows the founders’ ownership of the company.

source: https://www.spinlab.co/blog/step-by-step-guide-to-build-a-cap-table

This is relatively easy to understand. But what happens when there are outside investors who now have ownership?

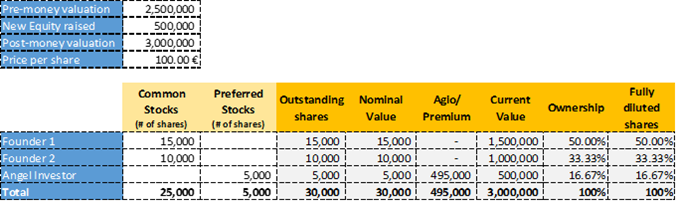

First Investment Round Cap Table

Pre-money valuation and investment amount are added to the cap table and a post-money valuation is then calculated by adding the investors’ funding amount to the pre-money valuation.

source: https://www.spinlab.co/blog/step-by-step-guide-to-build-a-cap-table

With the rise in the number of shares, the percentage of equity initially assigned to the founders will be reduced. This is dilution, which means a decrease in the portion of the company that has been assigned to existing shareholders. It’s also worthwhile to note that a fully-diluted cap table displays the number of shares (or units) that can be issued, exercised and converted, with all the outstanding shares of a company. This would include the number of vested shares at a specific date of a vesting plan. To explain in simpler terms, the fully diluted cap table is a version of the cap table with all the outstanding shares for each security along with the total shares for each convertible security when exercised – meaning a cap table dilution would occur.

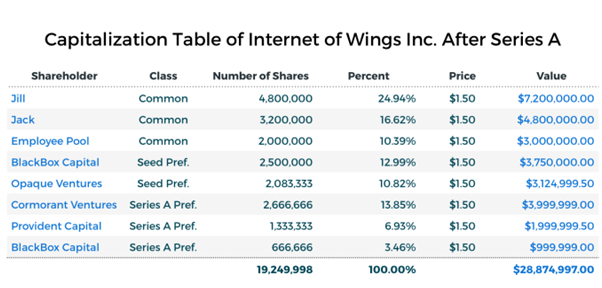

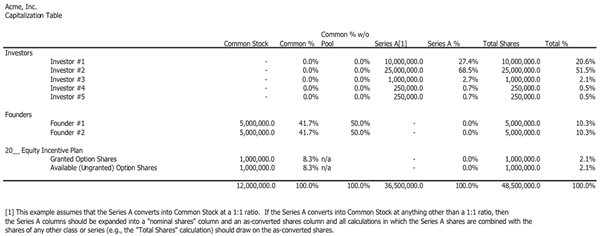

Second Financing Round: Series A Cap Table

Adjustments need to be made on a cap table every time there’s a financing event. The below capitalization table example shows how it would look post-Series A funding:

source: https://techcrunch.com/2017/09/06/cap-tables-share-structures-valuations-oh-my-a-case-study-of-early-stage-funding/

Further rounds of funding would mean less ownership for the founding members of the company, and more towards the investors. This is a running theme throughout all rounds of funding, and the cap table dilution needs to be updated thereafter just like we did after the Series A Cap Table.

Making a Cap Table: The Recipe

Now that you have a better understanding of what a cap table is, and how it would look down the line, it’s time to get your hands dirty! Let’s make one!

Cap table must-haves:

- Shareholder name

- Date of issuance

- Number of shares or units issued

Depending on your needs, you may choose to include:

- Valuation: Total cost of your business shares

- Total of authorized shares: The number of shares your company is authorized to sell

- Total number of outstanding shares: The total number of shares held by all stakeholders in the company

- Reserved shares: AKA restricted shares, the total number of shares available for employees.

source: https://blog.hubspot.com/sales/cap-table

How To Use a Cap Table

- Understand your equity:

Use the table to know what the outcome would be if you were to opt for an employee option pool or another fundraising round. It shows you the proposed new structure of the company.

- Plan out initial equity distributions:

While it’s hard for founding members to give away a part of their business, it’s needed. The cap table shows the written-down version of your company ownership breakdown. Use the cap table to show you the effects of equity distribution.

- Employee Options Management: Stock options are the best way to recruit and keep the best talent in your organization. The cap table shows you how many authorized shares are available at any given period.

- Negotiate your term sheet:

If you feel like you’re giving away too much of your business for too little, the cap table is a tool that will help show just how much of the equity you give away. It’s a critical tool in early fundraising decisions.

Maintaining a Cap Table

Reasons why cap table management is needed:

- Increased Investments

- More funding rounds

- More employee stock options

So, here’s what changes in your cap table;

- Valuation

- Investors

- Reserve/restricted Stock

- Debt that has converted to equity

- Total outstanding shares

- Remaining authorized shares

Takeaway

Now that you have everything under your belt to get started with a cap table, it’s much easier for you to make decisions surrounding equity. Understand the ownership outcome for each decision you make. This will help you stay prudent throughout your fundraising journey. For help, guidance and guaranteed success, call us at +1-213-600-7272 and we’ll help build your dream business.

We optimize & accelerate growth for already great products.

Valuation Practices for New-Age, Pre-Revenue and Early-Stage Companies

Valuation is often perceived as a mechanical exercise—an output generated by spreadsheets, formulas, and forecasting templates. While this perception may hold partial validity for mature companies with stable operations and predictable cash flows.