The Importance of Funding for Businesses

A business empire is not built on blood and sweat alone. Even Steve Jobs had to sell his Volkswagen car to fund

By teammarquee . December 15, 2021

A business empire is not built on blood and sweat alone. Even Steve Jobs had to sell his Volkswagen car to fund the creation of Apple. The importance of money to set a business off the ground cannot be exaggerated. It is an absolute necessity. It is this necessity that makes resources around funding a business some of the most searched topics across the internet.

The global funding in the first half of 2021 has already broken records with more than $288 billion investments taken place worldwide. On a global scale, there are now around 900 unicorn companies, many of which are expected to go public soon. Investors are looking for companies that can become the next Facebook, Spotify, Instagram, etc.

The way the funding industry is moving forward is a sign that it is all set to create business empires across domains. This upward movement is leading to a situation where businesses have started asking questions around investor funding.

Today, we are going to answer the one basic question – what is the importance of funding for businesses.

For a business, fundings does not just help them initiate their journey but help with hiring a team, buying equipment, marketing and promoting their brand. Even though the world is filled with use cases of how lack of funding support can lead to brand failures, there are companies that don’t acknowledge the importance of funds in a business. Let us solve this.

Importance of funding for startups

The benefits of funding for business sometimes go beyond the financial support. It can help new entrepreneurs with the guidance and support they need to become successful industry leaders. Let us look into some of the benefits of business funding.

1. Set the business off ground

The first and most pivotal use of funds is to get the business off ground. Funding can help an employee become an entrepreneur by giving them the necessary monetary support to atleast run a hypothesis on the idea and convert it into a concept.

At Marquee, we work with entrepreneurs and help them draft their vision into a funding-friendly business idea. We also help guide them through the pitch and funding round discussions to prepare them for what’s to come.

2. Get hiring support

Funds can help businesses find the best team and make the hire. It can support the team’s salary till at least the business starts making profit or even reaching a breakeven point. Apart from the salary front, a company which gets tagged as being invested in, finds it a lot easier to hire quality people compared to the startups without any funding support.

3. Helps with the operational side of the business

Another benefit of startup funding can be seen in the fact that it gives businesses the monetary support to rent out an office place, buy office equipment, invest in software, etc. In short, it can help with setting up the operational side of the business – at least for the initial few years, till the time the brand is able to sustain on its own.

4. Support marketing and promotional activities

Marketing and promotion of a business is one of the key areas which a startup spends most on. The reason behind it is that they have to establish themselves in the market from scratch – a market where a number of seasoned players already exist. Funding on this front can play a massive role in supporting this expense for the business.

At Marquee, we have helped a number of businesses set off their promotional activities with the aim to become the world’s best brand in their category. Our consultants carry extensive experience of working with multiple businesses, across sectors. This experience gives them an in-depth knowledge about what it takes to make a business big.

5. Guide entrepreneurs to become thought leaders

One of the most overlooked benefits of startup funding is the fact that investors just don’t offer financial stability. They offer guidance as well. Having backed a number of businesses, investors come with a lot of experience needed to build a business. And since their monetary growth is dependent on the company’s growth scale, they ensure that they give you all the tools and learnings to be successful.

6. Help businesses move from local to global

There is often always one thing between a business that runs its operation on a local ground vs one that is global – funds. The right investors can give brands the necessary monetary and advice-related support that plays a role in taking them forward on a global scale.

7. Give businesses a competitive edge

Up until this point, you must have gathered how the benefits of funding are much bigger than monetary support. It can help businesses get a competitive edge in the market.

The investors, when they back a company, back them through their guidance and business outlook as well – something that cannot be replicated by others in the industry. This combination of monetary and business insight gives businesses a competitive edge, helping them set their own business standards.

8. Growth funding

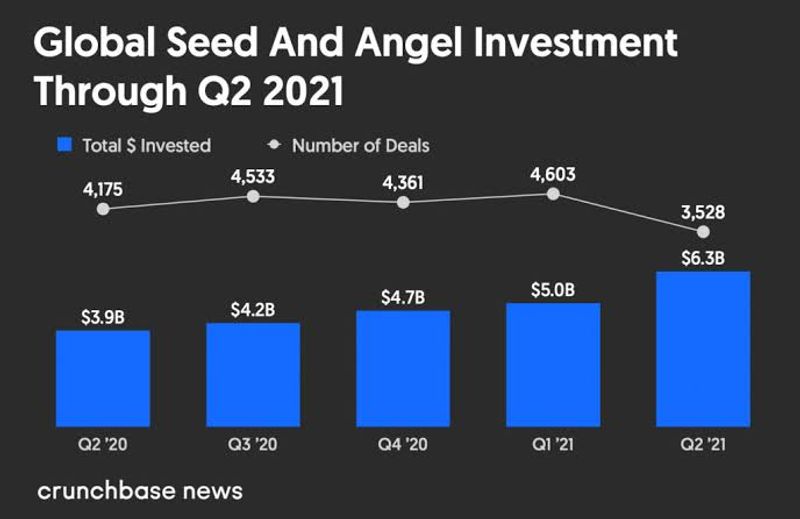

Image Credit: Crunchbase

Whether businesses wish to increase their sales number, expand the scope of their product or service, or grow on a local or global scale, growth funds can help them get there. A financial arrangement that comes with funding.

Irrespective of what the definition of growth for a company is, funding can help them get there.

At Marquee, we have helped a number of businesses fuel their business growth by partnering them with the best investors around the globe. We recently helped a Brazil e-commerce company raise $3M, overlooked a $100M crypto marketplace acquisition, and hand-held an Indian fintech company through its $2M funding round. We can help you too.

9. Give businesses credibility in the market

A business, the moment it gets funding, becomes credible. It goes unsaid that if an investor is backing a company they would have run their due diligence, meaning the brand already has everything that goes into the making of a future domain leader.

Funding, whole and sole, leads to an upped credibility factor which results in businesses getting more customers, better loan rates, and hiring support.

Now that we have looked into the multiple use of funding in a business, it is time to delve into the different types of startup funding.

What are the different types of funding?

The growth in fundings, across types are on an all time high on a global level –

Image Credit: Crunchbase

However, for an entrepreneur, it is very important to know what are the different types of funding they can apply or pitch for. Here are some of the most common funding models that a business generally chooses from.

Small business loans

When we talk about business funding options, small business loans are the first thing they look up to. The small business loans are very similar to personal loans in a way that they are approved a certain amount of funds in return of a rate of interest.

Business people can get the small business loans through both banks and other financial institutions which can generally be found on Small Business Administration (SBA).

Funding rounds

A number of startups go through multiple funding rounds. The fundraising stages can be categorized into three groups: Series A, Series B, and Series C funding. Each of these categories are aligned with the stage the company is at. In each funding round, money is usually exchanged for some company equity, this means that the investors take a return in company share on their investment.

Venture capitalists

When we talk about the sources of funds for business, it is impossible to not mention VCs. A venture capitalist is a private investor who gives funds to promising startups. They are often a part of a larger venture capital company who has a board which votes on which company they will be backing.

When the company gets chosen by a venture capital firm, the VC reaches out to the company with a fund offer. Traditionally, the venture capitalists take equity in the company, which means that they want to get a payout.

Crowdfunding

For entrepreneurs, the combination of a business idea and little to zero funding takes them to crowdfunding.

It is a type of funding in which small amounts of capitals are raised from a number of individuals to back a business venture. The fund type makes use of the wide network of people on crowdfunding websites and social media platforms that bring entrepreneurs and investors together. This model, doesn’t just help increase the entrepreneur network but also the investors circle by giving individuals a chance to become serial investors.

Incubators

A business incubator or accelerator program as it is commonly called, is a group which is centric to helping set businesses off ground. The incubators are usually founded and funded by other companies which want to help emerging businesses reach their complete potential. They also provide space for the companies to work in, give funding assistance, and even provide mentoring. The holistic nature of support which they offer makes it one of the most popular sources of funds for business.

Conclusion

With this, we have now seen the many reasons why the business needs funding and the different ways to earn funds.

In the upcoming articles, we will talk about the different facets of how to get funding and share some expert opinions about funding startups. But in every scenario, the next step would be to get in touch with the people who can help you shape your idea and take you to investors who can convert it into a successful business. Marquee can help you.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.