The Ease of Fund Raising Via Private Placement of Shares

The growth of the private placement market has led to an easier fund raising process with improved standardization of documentation, visibility of pricing as well as increased capacity for financings. So, the private placement market can accommodate transactions as small as $10 million and as large as $1-$2 billion.

By teammarquee . April 5, 2022

There is no denying the fact that it is important for all companies to have sufficient funds for running a business. In the competitive era that we live in, private placement of shares is what businesses are practicing for fundraising.

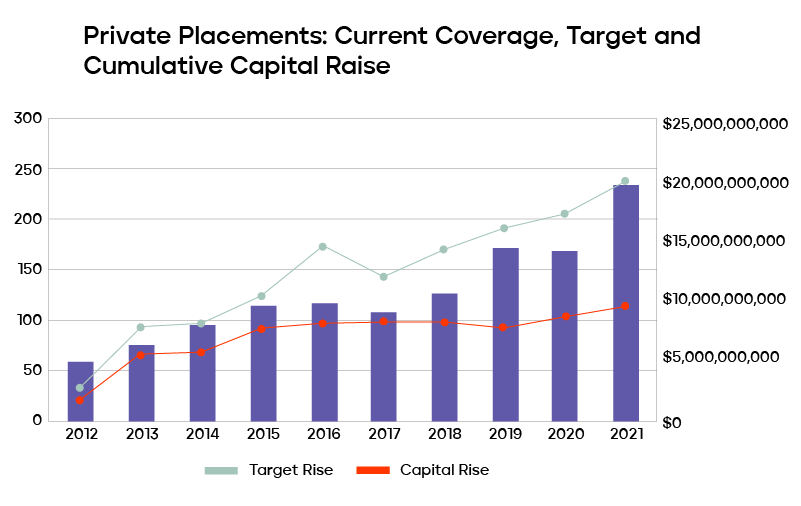

As of December 1st 2021, AI Insight covered 234 private placements currently raising capital, with an aggregate target raise of $19.9 billion and an aggregate reported raise of $9.4 billion or 47% of target.

The average size of the funds that were raising capital at the time was $84.8 million, ranging from $5.0 million for a specified real estate fund to $1.1 billion for a private equity tender offer fund.

When a company is seeking to raise capital for expansion, private placement, as the name suggests, is a private sale of stock shares or bonds to pre-selected investors and institutions rather than on the open market. Private placement of shares is an alternative to initial public offering (IPO). In simple words, while fundraising for a business, if the securities are sold through a private offering to a small pre-selected group of investors it is termed as Private Placement.

Generally the investors invited to participate in fundraising via private placement include wealthy individual investors, banks and other financial institutions, mutual funds, insurance companies, and pension funds.

There are various benefits for companies by issuing in the private placement market such as, maintaining confidentiality, obtaining long-term, fixed-rate capital/funds, expanding financing sources and creating additional financing pipelines. Moving forward, let us discuss the advantages of private placement over other forms of fundraising.

What Are The Advantages of Private Placement?

1. Confidentiality and control

If you value the privacy of your company, private placement will be highly beneficial for you. With this practice of fundraising you get the privilege to not disclose company information like financial documents and terms, debt and equity offerings, etc. The transactions can be negotiated confidentially and public disclosure is not necessary providing you full control of the image of your company.

2. Increased efficiency and cost effectiveness

One of the major features of private placement includes cost effectiveness and time efficiency. Raising capital through public offering can be a very time consuming process. When it comes to public issuers, the registration, legal documentation, etc. for Security and Exchange Commission can be expensive. Having said that, the cost and time utilized during the process will be a burden on the company. So, companies can go for fundraising via private placement of shares at a much lesser cost and save time.

3. Better investor relationships

The private placement process includes transactions that involve fewer than 10 to 20 investors unlike the public market where companies issuing debt securities have to deal with hundreds of investors. This approach can simplify the relationships you share with the investors as you will get the time to concentrate on how you can improve your banter with the key financial partners and generate more funds for your business.

4. Quick execution

Private placement has a quick execution process when compared to a public corporate bond, especially if you are a first timer, mainly because of prospectus drafting, registering with the SEC and rating agency diligence, etc. Fundraising via private placement can be more efficient and hassle free as it provides a standardized documentation process plus a smaller universe of investors that leads to quick and easy execution of an investment.

5. Additional financial capacity

Companies generally outgrow their borrowing capacity and need funds despite what their existing lenders can provide. So, they seek out private placements and focus on the cash flow that they can get either on a secured or unsecured basis, depending on the company’s existing capital structure.

Now that you know the advantages that private placements have to offer, you should also be aware about the loopholes.

- Confined market for the shares in your business.

- Limited number of potential investors, who may not want to invest substantial amounts individually.

- You might have to place the shares of your company at a discount to attract investors for their greater risk and long-term returns.

The advantages and disadvantages of private placement are crystal clear, we can jump onto the criteria that is essential for private placement. So, without further ado, let’s discuss, shall we?

What is the Criteria For Private Placement?

- Under Private Placement an offer can be made to not more than 200 people. The invitation to subscribe cannot be sent out to more than 200 people. Within this 200 people limit Qualified Institutional Buyers and Employees are excluded.

- The money is payable through cheque or demand draft or other banking channels but not by cash.

- The price of the security has to be justified and it also requires a valuation report by a registered valuer

- The company is required to maintain a complete record of private placement offers in the Form PAS-5.

- The offer of securities amounts to a private placement and is governed by section 42.

Having said that, the criterias involved in the private placement process can be tricky. In order to raise funds via private placement of shares, it is most important to find a private placement investor who can meet your financial needs and is also best fitted for the goals of your business. If you’re interested in issuing a private placement, Marquee Equity is here to help.

We optimize & accelerate growth for already great products.

Valuation Practices for New-Age, Pre-Revenue and Early-Stage Companies

Valuation is often perceived as a mechanical exercise—an output generated by spreadsheets, formulas, and forecasting templates. While this perception may hold partial validity for mature companies with stable operations and predictable cash flows.