The Key Differences Between Venture Capital and Angel Investors

Explore the world of startup funding and the key differences between Venture Capital and Angel Investors. Learn how to make informed decisions for your business journey, weighing the pros and cons of each financing option.

By teammarquee . September 25, 2023

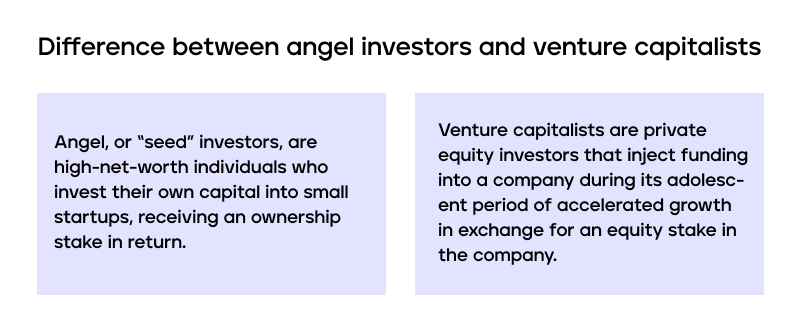

Entrepreneurs embarking on their business journeys often require external funding to bring their visions to life. VC and angel investor financing are two common ways startups secure funding. Venture capital (VC) entails providing financial support to promising, high-growth companies in return for ownership stakes. In contrast, in the Angel investor funding model, a group of affluent individuals invest their capital in early-stage startups in return for ownership stakes.

In this blog, we will make angel investment and Venture capital funding comparisons in the startup environment and talk about each of their attributes, benefits, and burdens. Before diving deep into the venture capital vs. angel investors debate, let us briefly understand these two Funding options for startups.

Venture Capital vs. Angel Investors

While both angel investors and venture capitalists are two major sources of alternate funding, there are several disparities between the two. While angel investors operate independently and invest their own money, venture capitalists are generally employees of risk capital companies investing other people’s capital in innovative startups.

Below is a table showing Angel investors versus venture capital wherein we will talk about some major differences between the two based on four important aspects: investment size and stage, Venture capital funding sources and screening process, equity stake and post-investment role, and investment criteria and approach to risk.

VC vs. Angel Investment

| Aspect | Venture Capital | Angel Investors |

| Investment size and stage | Larger amounts ($1 million to $100 million) at later stages (Series A and beyond) | Smaller amounts ($25,000 to $100,000) at earlier stages (seed or pre-seed) |

| Funding sources and screening process | Institutional funds from limited partners (e.g. pension funds, endowments, etc.) with rigorous due diligence and formal agreements | Personal funds from individual investors with less formal evaluation and negotiation |

| Equity stake and post-investment role | Higher percentage (20% to 50%) with more control and influence over strategic decisions | Lower percentage (5% to 25%) with less involvement and interference in daily operations |

| Investment criteria and approach to risk | Focus on scalable and proven business models with clear exit strategies (e.g. IPO or acquisition) | Willing to invest in innovative and untested ideas with longer-term horizons |

How do Venture Capitalists fund companies?

The term sheets from each investor appear incredibly different, even though both venture capitalists and angel investors put money into businesses with the expectation of a strong return on investment (ROI). Since their money is often gathered from other investment firms, significant enterprises, and pension funds, venture capital firms have far more to invest ($7 million on average).

Venture capitalists perform thorough due diligence to keep their partners’ fiduciary responsibility as the investments are significant. Investors should anticipate a thorough investigation of the company’s business strategy, finances, market, goods, management, and operational history. Large-scale venture capital investment often requires an enormous interest in your business. In fact, VCs may also take a seat on your company’s board of directors and may reinforce their ability to influence the startup.

How do Angel investors fund companies?

On the other hand, angel investors choose to invest their own money; sometimes, they may form an angel investor network with other angels to invest in a startup.

Angel investment criteria generally involves performing less due diligence because all wealth belongs to the angels themselves, and they’re not really obligated to do so. They take on more risk and have less influence over how you run your company. They instead place more trust in the founder and the founding group. Even so, they can still support the expansion of early-stage businesses because of their expertise, contacts, and business acumen.

Seeking VC and angel investor financing has some advantages and disadvantages for startups. Let us first discuss the pros and cons of venture capital investments and angel investments. This will also help you understand the differences between these two sources of startup funding.

Pros and Cons of Venture Capital

Seeking venture capital funding sources also has some advantages and disadvantages for startups.

Pros:

- One of the benefits of VC investment is that it gives a lot of capital that can help new businesses accomplish economies of scale.

- Another benefit is that venture capitalists offer strategic guidance and organizational support, which is sometimes vital for startups.

- A VC investment often brings an extensive network of contacts from the business world, including other entrepreneurs, potential customers, partners, and industry experts, which can be an added advantage for startups.

Cons:

- One major disadvantage of VC funding is that businesses need to surrender a lot of organizational value, which implies losing more proprietorship and command over their business.

- VCs often expect high investment returns within a short time frame. They often seek strong startups with competitive products or services, a talented management team and a wide-ranging market potential.

- Sometimes, venture capitalists may have conflicting goals and agendas than founders, such as pushing for faster growth or exit.

Let us now discuss Angel investor benefits and drawbacks to understand this funding source better.

Pros and Cons of Angel Investments

Pros

- One benefit of the angel investor funding model is that they may fund newer and unproven businesses that are too risky for VCs or banks.

- Another advantage is that angels can give mentorship and systems administration to business people, as they frequently have applicable industry experience and associations.

- Also, in contrast to grants and loans, angel investments do not require monthly/quarterly repayment, easing startup financials.

Cons

- One disadvantage is that angel investors mainly offer financial assistance and are not directly involved in a company’s management and marketing potential.

- They mostly specialize in early-stage companies, so if you own a finance or tech startup looking for funding at a later stage, you might have to opt for VCs.

- Another drawback is that finding angel investors can be challenging, as they are less visible or organized than VCs.

- Sometimes, founders and angel investors might have different goals and interests, which could cause disagreements or misalignment.

Conclusion

Choosing between angels and VCs will mainly depend on the stage of your startup. So, if you are a startup seeking seed funding to kickstart your venture, then seeking angel investors for your business may be a better idea. However, if you are an already established business ready to handle increased responsibilities, partnering with a VC firm can help you grow.

This decision also hinges on several other factors like appeal, profitability, and market size. Not every business or concept aspires to achieve the “Unicorn” status. Smaller enterprises can still generate profits and provide investors with respectable returns. Therefore, it’s essential to contemplate your objectives and your position with respect to startups and investor types to determine the most suitable option for you.

We optimize & accelerate growth for already great products.

Valuation Practices for New-Age, Pre-Revenue and Early-Stage Companies

Valuation is often perceived as a mechanical exercise—an output generated by spreadsheets, formulas, and forecasting templates. While this perception may hold partial validity for mature companies with stable operations and predictable cash flows.