What Should an Entrepreneur Know About Cap Table?

Suppose your brand is a Netflix series, the cap table will be the closing captions addressing who did what. For any entrepreneur,

By teammarquee . December 29, 2021

Suppose your brand is a Netflix series, the cap table will be the closing captions addressing who did what. For any entrepreneur, it becomes important to have a clear understanding of who owns what at every stage of the business in cases where they are raising money or are simply starting a new business.

This is where a cap table comes into the picture. Also known as the capitalization table, it is a document that gives you the information you would need to understand your company’s ownership. In this article today, we will dive into the different elements of a cap table, getting you one step closer to understanding cap tables.

What is a capitalization table?

The ownership in a startup keeps on changing as it grows and moves through the funding rounds. This can be driven by new investors buying in the business, the stock options getting exercised, or the convertible notes getting converted into stocks. The capitalization table is used for tracking these changes and keeping a record base of all the present and potential company shareholders.

A basic capitalization table lists out each type of equity ownership capital, the individual investors, and the share prices. A more complex table may also include details on potential new funding sources, mergers and acquisitions, public offerings, or other hypothetical transactions.

What is the benefit of a startup cap table?

The capitalization table for startups is an important document for a range of reasons. It is crucial for an entrepreneur to understand the complete scope of a cap table for startup as it best illustrates the health of their company to the stakeholders.

1) Investor’s knowledge

When you pitch your company to the investors, they want to look into how the company ownership is structured. They need information on the present makeup, the previous finance rounds, and the impact of the investments on their shareholding. The VC cap table informs them where they rank in shares and the amount of money they require to better their position.

A cap table sometimes acts as a startup valuation spreadsheet. It is a perfect document to manage the company shareholders, know the amount of shares they have and the percentage of the company they own. The document will also help you with knowing when the shares will get issued to the shareholders. What is important, however, is that you keep the document updated by adding transactions around convertible notes and options.

3) Access to legal documents

The VC cap table doesn’t just track the number of shares but also the legal documents which go with every transaction. One of the key importance of cap table lies in the fact that it is a great resource to track important legal documents and verify the legal forms that have been recorded.

4) Track important dates

The cap table doesn’t just track the present investors and shareholders but also keeps a tab on the dates when the convertible bonds, warrants, and options are going to be converted into company shares. This, in turn, helps entrepreneurs make better staffing decisions and make plans for their company.

Now that we have looked into what is a cap table and what is the importance of cap table, it is time to look a little into the details of the cap table specifications.

What are the main terms used in cap table analysis?

Whether you are building a cap table for your internal usage or you are going to send it to the investors, it is crucial that you understand the terms mentioned in it. In order to help you grasp it sooner, our team at Marquee has broken down the terms into three prime segments: Valuations, Security Types, and Share Counts.

Valuations

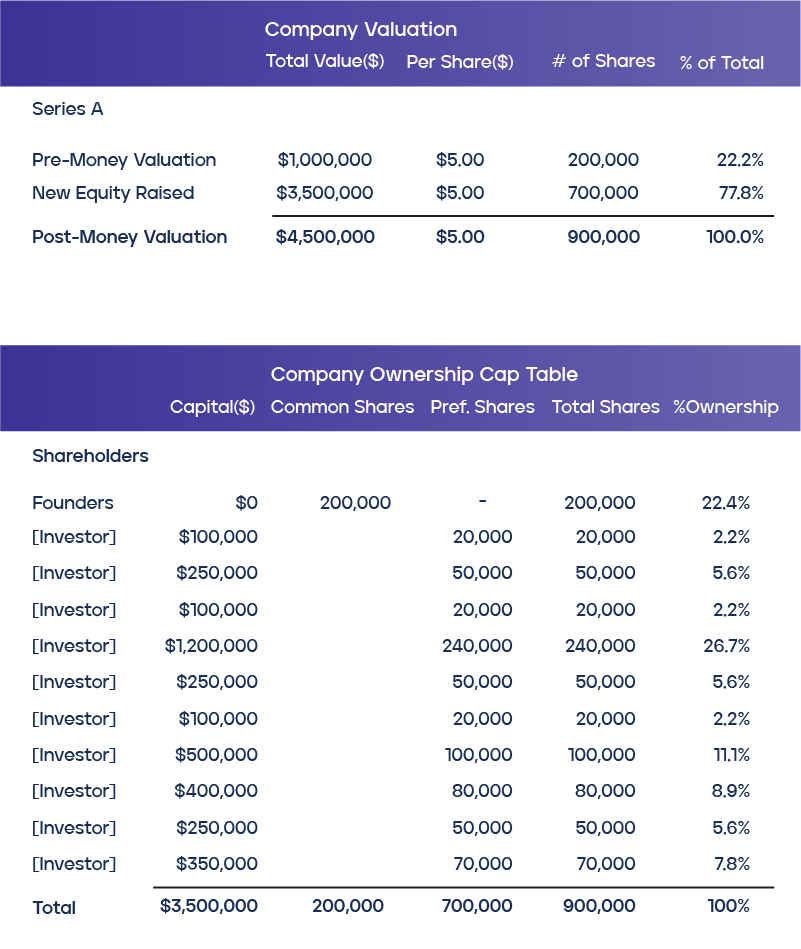

A key part of the cap table is the pre and post money valuation spreadsheet and the price per share.

Pre-Money Valuation – It is the valuation that is placed on the company before someone invested in it. The valuation is usually set through several rounds of negotiation between the company management and the investors.

Post-Money Valuation – It is the valuation of the company which comes in after an investment has been made in it. For example, if the pre-money valuation was $2M and investors made a $1M investment, the post-money valuation would become $3M.

Price per share – It is the calculation that is based on taking post-money valuation and dividing them by a number of completely diluted shares. So suppose you have a $15M post-money valuation and we have 3 million shares, the price per share will be $5.

Security Types

Common Stock – The most basic type of equity ownership is known as common stock. Every share of the common stock indicates partial ownership in the company and gives shareholders rights to the company profits.

Preferred Stock – These are the class of stocks that carry special privileges and rights that are outlined in company’s charter. These stocks are usually paid before the common ones in case of sale or liquidation situation.

Stock Options – The stock option is a right to buy a specific number of shares at a certain price. They are usually issued under the stock option plans that are kept aside for restricted stock grants and options.

Authorized Shares – Authorized shares are those shares that have been authorized by the board of the company for current or future issuance.

Outstanding Shares – This is the total number of shares that have been issued excluding ones that have not been granted and ones that have not been exercised.

Fully Diluted Shares – The total number of common shares of a company that will be outstanding and available to trade on the open market after all possible sources of conversion, such as convertible bonds and employee stock options, are exercised.

How to build a cap table?

A majority of the capitalization tables are built on a spreadsheet at the beginning of a business. You will also have the option to build it on dedicated software. Now, whatever mode you choose, you should structure it around these elements –

Ownership stake who (investors, founders, or employees) owns which amount of business or has what percentage of control over the company. Because a majority of the startups need a voting agreement between the preferred and common shareholders, the view gives insight on who has to sign off on key business decisions. The section will also have a list of shareholders’ names and the amount of shares which they hold.

The types of shares show who holds common shares versus who has preferred stock options.

Debt that can be converted into equity is a transaction type that is often found on a cap table. It is factored in all the ownership calculations on a completely diluted basis. Calculating debt on a completely diluted basis is an approach of looking at ownership where all the outstanding options, warrants, and convertible notes have been exercised.

Basis your specific business needs, you can decide to add some other variables in your cap table as well:

- Valuation: The total cost of business shares

- Total of the authorized shares: The number of shares you are authorized to sell

- Total number of outstanding shares: The number of shares held by stakeholders in company

- Reserved shares: The total number of shares available to employees

How To Maintain a Capitalization Table?

Cap table management is essential as the things that are relevant for a business when it starts tend to change over time. For example, events like greater investments, funding rounds, and increase in employee count can change the numbers in the cap table. Thus, it is extremely important to keep the table updated with the latest information. Here are some things to keep track of and keep updating in the cap table:

- Valuation: Whenever the stock price changes.

- Investors: When you get investors.

- Reserve Stock: If you provide stock to employees, modify the number of shares when you hire

- Debt which has been converted to equity

- Total outstanding shares

- Remaining authorized shares

In addition, it is necessary to make sure that there are specific teams or key people to manage the cap table. If multiple people have edit access, it can be confusing when people are working on different columns together.

Marquee can help

Knowing what a cap table is and building one are two different ball games altogether. There are a number of entrepreneurs who don’t start with building a capitalization and struggle when the time to raise funding arrives.

We can help you build your cap table. We have helped a number of businesses set up their documents as a way of preparing them for their investment journey. Reach out to us.

We optimize & accelerate growth for already great products.

Valuation Practices for New-Age, Pre-Revenue and Early-Stage Companies

Valuation is often perceived as a mechanical exercise—an output generated by spreadsheets, formulas, and forecasting templates. While this perception may hold partial validity for mature companies with stable operations and predictable cash flows.