How to achieve sound valuations in mergers and acquisitions

Merging and acquisition valuation of a business may seem an intimidating task. Fortunately, there are several frameworks and strategies to get a fair deal and obtain maximum valuation possible for the business. In this write-up, we’ll share some of the best practices that one can inculcate in his/her financial analysis structure and achieve sound valuation.

By teammarquee . May 26, 2022

When formulating the strategies to commence M&A valuation process, one must consider several factors that can proliferate the valuation of the business thereby ensuring a successful deal. Factors such as market comparables, valuation method, last round’s valuation method, and many more, can dramatically impact the final terms/numbers of the valuation. Therefore, through this write-up we will help you in closing the best deals possible by focusing on some successful mergers and acquisitions strategies.

What are Mergers and Acquisitions?

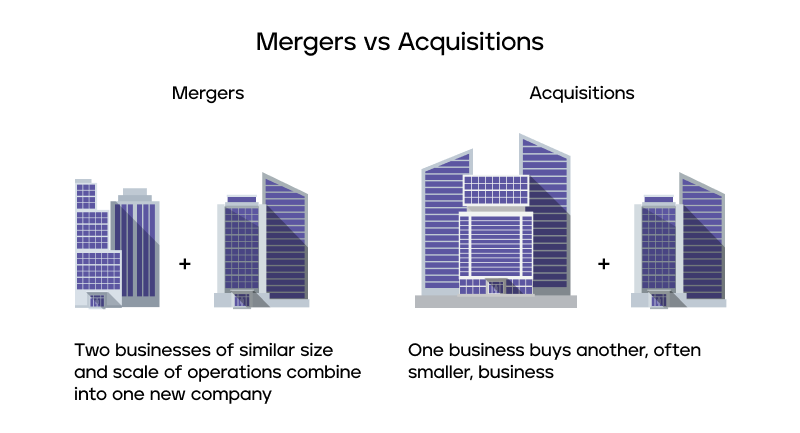

When two companies consolidate to form a new entity with renewed management structure and ownership, then the process is known as a merger. A merger is a friendly conduct of amalgamation, and requires both the organizations to surrender their stocks and issue new stocks under the fresh entity’s name.

Acquisition, on the other hand, is the process through which a larger company ceases the assets of a smaller company thereby making it its part. However, no new entity is formed in an acquisition.

What is the difference between Merger and Acquisition?

It should be noted that while in a merger, two entities agree to combine and form a new entity altogether, in an acquisition no such entity is formed; rather, the bigger entity takes over the operational, management and overall decision making authority. However, a right acquisition can do wonders to the growth of your business.

What are different Methods of Mergers and Acquisition Valuation?

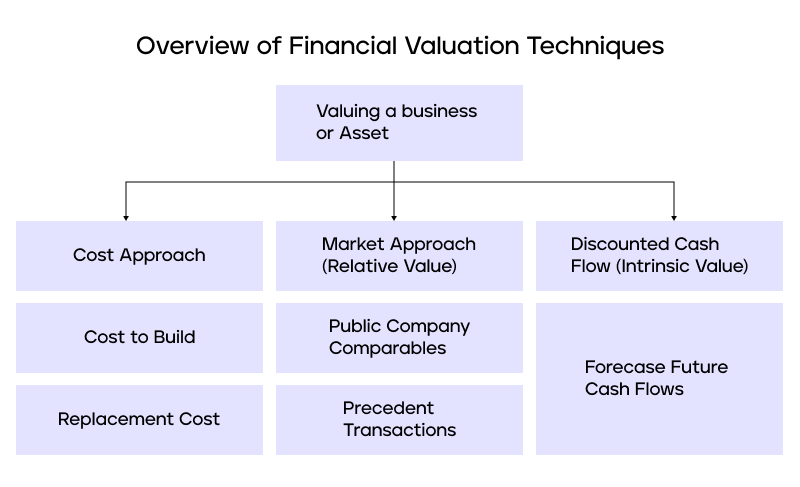

It is a matter of fact that even if the same company is evaluated on the same date, the valuation may vary as the method of valuation changes. This is because different methods approach the business through a different perspective and focus on specific aspects of it. Three most general methods to ascertain the valuation of a business are: the cost approach, the market approach and the discounted cash flow approach.

- The Cost Approach: This method looks primarily at the balance sheet of the business to derive at the valuation of the business based on the underlying assets of the business and liabilities against it. Further, these assets and liabilities are restated to a fair market value. Generally, intangible assets such as goodwill, copyrights, etc. are absent in the balance sheet and must be added.

- The Market Approach: Under this method, the company is valued on the market comparables. Sales figures of competitors over a reasonable timeframe are used to ascertain the M&A valuation of the business. This information is derived from the publicly available data that the competitors publish over a period of time.

- Discounted Cash Flow Approach: This method derives the valuation term on the basis of expected cash flow in the near future and forms the basis of the valuation of the company for merger and acquisitions.

While above mentioned are some of the conventionally used methods to ascertain the value of a business, there are some other methods as well to evaluate the business.

- Net Assets: The method is one of the easiest formulas to achieve the valuation of a business. In this method all the liabilities of the business are subtracted from the assets of that business. However, it doesn’t consider future projections into account.

- Revenue Multiple: It is one of the most commonly used methods of valuation for mergers and acquisitions, as it compares similar companies with different profit margins. This method provides the most suitable metrics for convenient valuation. This method is optimal for Tech companies as the low profit earnings are compensated by high future earning potential of the company.

- EBITDA (Earnings before Interest, Tax, Depreciation and Amortization): This method deals with the financial performance of the company and compares it to similar companies thereby excluding capital expenditure, tax liabilities and many more.

Selecting the most appropriate method to obtain the maximum merger and acquisitions valuation is the most predominant task. The challenge, however, doesn’t end here. The deal doesn’t close with the valuation alone; it requires critical analysis of the scenario and proper market research to be able to escape yourself from being in a tight spot.

Ways to improve Your Valuation for M&A

Here are some of the ways by which you can improve your valuation for Mergers and Acquisitions:

- Optimal Due Diligence: Due Diligence is the in-depth study of the company that includes culture, infrastructure, management, values, history and other significant parameters to find the valuation of the company.

- Trust between parties: Trust between the management of both the parties is essential as it ensures a smooth M&A process. The chances of increment in the valuation increases if the relationship between both the parties is cordial.

- The earning capacity of the business: If the company has higher capacity to earn profits then it will automatically improve its valuation.

- Goodwill and Tangible Assets: A highly reputed company with good due diligence and more tangible assets will definitely have a sound valuation for M&A.

- Market share of the company: Determining the market share of the company in other words refers to determining the size of the company relative to the industry. A company with higher market share will have a greater valuation.

- Processes, Systems and Financial Reports: The company’s processes and systems if properly documented and thoroughly executed can ultimately determine the value of a company. Also the updated Financial Reports also play a significant role in adding value to the company when it comes to Mergers and Acquisitions.

- Technical and Operational Support: When it comes to M&A, then ascertaining the technical and operational support provided by the companies determines the successful completion of projects in the company. And eventually this directly impacts the valuation of the business.

Conclusion

Knowing your numbers and future earning potential will help you in yielding the maximum outputs for which you will require expertised guidance and prior knowledge. Don’t worry! Marque Equity has got our back. The professional team through strategic planning will help you in getting maximum valuation of mergers and acquisitions for your business.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.