The Difference Between Limited Partner vs General Partner

Getting into a business partnership is one of the most crucial decisions an entrepreneur can take. The decision doesn’t just impact the

By teammarquee . December 15, 2021

Getting into a business partnership is one of the most crucial decisions an entrepreneur can take. The decision doesn’t just impact the future of the business but also affect the level of control a sole entrepreneur would have to share.

There are a number of different partnership options available in the US market. But when we talk about private equity, there are two which become primal – ones we are going to compare today: Limited partner vs General partner.

Let us dive right into it. Starting with the definitions of what is Limited partnership – LP in private equity and what is General Partnership – GP in private equity.

What is a Limited Partnership?

Under the limited partnership system, there are one or more general or limited partners. In this partnership form, at least one person should be a general partner. The limited partners are usually only accountable and responsible for the debts which they have in the business.

Limited partners come with very limited control. With complete focus on the returns of investment, they have limited involvement in the business entity and zero control over the management. Their income, pre-mentioned in the agreement – is the return on investment which they get on the business performance.

What is a General Partnership?

In generic terms, the general partners can be considered the owners of the firm. They play a crucial role in the management, operations, administration, and any kind of decision making in the company.

The general partners carry an unlimited liability attached to the finances of the firm. Meaning, in case of business insolvency, their assets can also be considered for settling the debt. Lastly, like limited partnership, the returns – in profits and losses – are also shared according to the pre-mentioned terms in the partnership agreement.

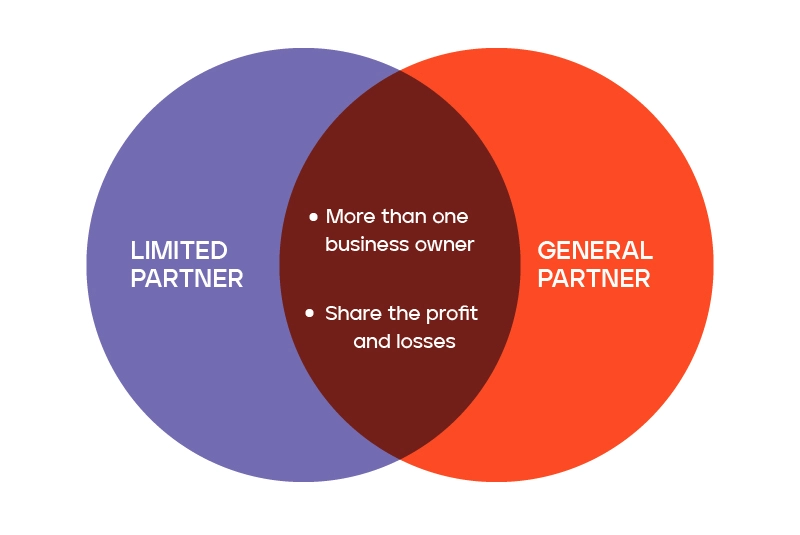

Limited Partner vs General Partner: Similarities

While there are several key difference between LP and GP, there are some similarities between both the partnership types.

For example, in both partnership types, there has to be more than one business owner. Moreover, both the partners must contribute to the business, it can be through industry expertise, labor, property, or finances.

Moreover, partners in both the types share the profit and losses the firm makes. Additionally, the owners don’t have to file different taxes, they report profit and loss when they file their personal tax returns.

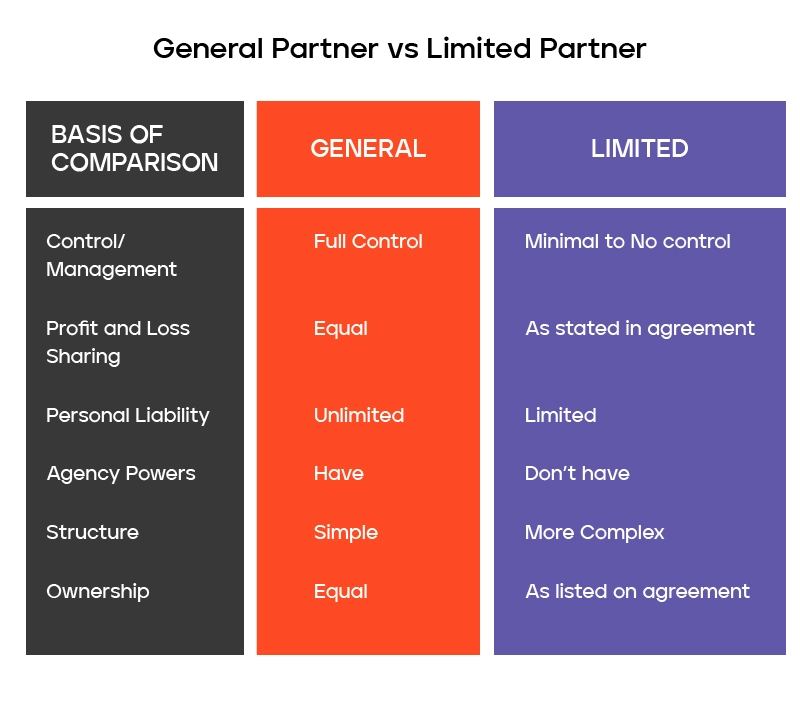

Difference Between Limited Partner and General Partner (LP vs GP)

The factors of LP vs GP differences range from definition to ownership and everything in between. Understanding these differences can help with knowing what GP and LP in private equity stands for. An understanding that can lead to the creation of profitable business partnerships.

Management

In general partnership there is an equal division of assets and labour. The role of general partnership can be divided as the core team seems fit but all the partners must be completely involved in the business operations.

In the case of private equity limited partners, there are always general partners who oversee business operations, so the role of limited partners is not to be involved in the day-to-day working of the business. Unlike general partners, limited partners do not have the equal decision-making powers.

Liability

In terms of liability, both limited and general partners have the same liability levels, however the amount might differ. Unless stated in partnership agreement, the general partners will equally share the liability, profits, and losses in the company. The characteristics of general partnership are designed in a way that their assets are also liable for the firm’s obligations and debts.

It is, however, not the case with limited partners. In this structure, the general partners are still completely liable while the limited partners are only liable for the amount they have put into the business.

Setup

In case of general partnership, it doesn’t have to be registered with the state in which it operates. If an entrepreneur goes into a business with one or two partners, it automatically becomes a general partnership. Because the setup is so easily formed, we recommend creating a partnership agreement with ironclad terms and agreement.

Limited partnerships, call for additional steps compared to the setup of a general partnership. Usually, an entrepreneur would need to file the certificate of limited partnership with the state’s secretary.

Agency Powers

The general partners can make legally bound decisions and bind the firm to a business deal or contract.

The characteristics of limited partnership states that they don’t have such abilities.

Restriction on Ownership

The ownership of general partners in a firm is equal unless otherwise stated in the partnership agreement.

The ownership of limited partners in business is limited to what is mentioned in the agreement.

So here were the key differences between LP and GP that an entrepreneur should know. In the end of the day, there are no correct partnership choices for a business firm. How involved a partner wishes to be will help in determining the type of partnership that would work best and so will the liability level they are comfortable with.

Irrespective of the decision, it is advised to get a partnership agreement made. This way, there will be no confusion around profit sharing, liability levels, etc. down the line. Team Marquee can help with making the partnership agreement for your business. Contact us, today.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.