3 Tips to Value your Seed Stage Startup for Successful Fundraising

Interactions with more than 100+ startups every week has made me realize that most of the founders are concerned about their business valuation. This is because raising capital successfully in the initial stages is directly proportional to the accuracy of their startup valuation. So, let’s understand how business valuation predominates the capital funding process at the seed-stage.

By teammarquee . June 14, 2022

As per “The Small Business Bible,” individual VC firms are more likely to receive more than 1000 proposals every year and are majorly piqued by ventures looking for an investment requirement of at least $250,000. But do you know how these entrepreneurs decided the amount of the equity that they would like to offer to the investors against such a huge amount? The answer is simple, through their business valuation. In this write-up we’ll discuss the startup valuation process and share some tips to value your startup at seed-stage.

Key Takeaways

- The process of quantifying the worth of a startup is known as Startup Valuation which acts as an actual deal breaker or deal maker while raising funds.

- Quoting higher value raises the expectations of the investors while under quoting the valuation may lead to excessive dilution of your business equity.

- Factors such as prototype, distribution channel, your niche industry etc. directly impacts your business valuation.

- By focusing on creating a perfect pitch deck, projecting capitalization table along with P & L Statement and honing up your negotiation skills can increase the chances of successful fundraising.

- Don’t forget that your valuation is a variable factor and can be negotiated while pitching.

What is Startup Valuation?

The process of quantifying the worth of a startup is known as Startup Valuation. In the initial phases, if a company raises funds through diluting its private equity shares, it means that the investors get entitled to that amount of the company’s share in exchange for the investments based on the valuation of the company. Business valuation helps investors in calculating their share of equity in the company and thus make decisions about investing in the company. It acts as an actual deal breaker or deal maker when it comes to raising funds for your startup.

Importance of Startup Valuation at Seed Stage

Now that we’ve understood the meaning of Startup Valuation and how correct valuation can influence the investors’ interest into your business, we should now focus on the importance of Startup Valuation.

Valuation in every startup is significant as it helps the founders in estimating the percentage of equity that they’ll have to give up to the investors in lieu of funds. Additionally, in order to analyze the actual value of your company, you should be aware of how valuation works. Quoting a higher value absentmindedly may raise the expectations of the investors in terms of the returns to be gained against the invested amount and if you’re unable to meet their demands then it automatically lowers your valuation in the next rounds which predominantly displays lack of commitment and overconfidence. On the other hand, if you quote lower valuation, then you may end up diluting more which makes it evident that more power in the business has been transferred to the investors. Therefore, calculating the valuation of your startup to the utmost precision is the best way to avoid future discrepancies.

Valuation Factors Affecting Startups at Seed Stage

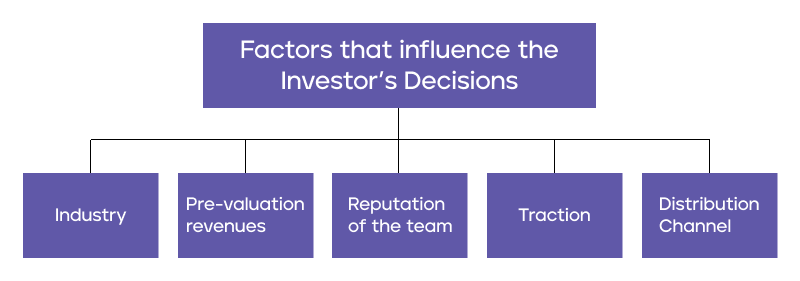

After understanding the meaning and significance of the correct valuation, we should rightly focus on the factors affecting the valuation of a startup at seed stage. These factors can influence the accuracy of your startup valuation.

1. Prototype: Prototype can play a significant role in influencing the decision of an investor. There has to be remarkable development of the prototype to convince the investors. So, it is important for you to know how to create a prototype. You can also seek professional guidance anytime for the same.

2. Pre-Valuation Revenue: Generation of revenue is the prime factor that can help you in alluring the investors towards your business. So if your business is generating any profits then you should leverage it while pitching in front of them.

3. Distribution Channel: Since the business is in the initial phase, it’s presumably evident that the product/services will also be in the initial phases. Therefore, founders need to be cautious about their distribution channel as it has a direct impact on the valuation of your startup.

4. Your Startup Industry: If your startup belongs to an industry which is bound to prosper then the chances of you raising capital successfully for your startup are higher. Choosing your business sector is therefore an important factor in determining the success of your startup.

5. Traction: Typically representing the customer demand quantitatively, traction demonstrates the growth and development of your startup.

Considering all the factors while pitching the investors can ensure successful fundraising for your startup. Having said that here are the best 3 tips to value your business at seed-stage.

Best 3 tips to value your business at seed-stage

1. Do your Homework

In order to get funding from the venture capitalist, you’ll have to convince them how your startup is a profitable venture and how the chances of your startup outgrowing the competition are higher. Establishing a strong professional connection prior to pitch deck presentation and focusing on piquing their interest may help you in ensuring that they are grasping information precisely. The information content may vary from the expandable size of your market to sustainability and even the uniqueness of your business idea. And all of this will cast a long lasting impact if you share this information in-person rather than over an email. Hence, you should keep in mind that your pitching should be nothing but perfect. You should effectively channelize your energy into creating a perfect pitch deck for your startup and upgrading your knowledge about the startup, revenue model, competition, industry trends etc.

2. Hone your Negotiation Skills

Gathering knowledge about other similar startups and how they have raised their funds is going to prove beneficial for your startup funding. Knowing about an already established startup in your industry with a similar business model and the capital they have raised back in their initial phases may give you a rough idea about the figure that you can expect to raise. Also consider the fact that they have raised that money a few years ago and owing to the unstoppable inflation you should derive your conclusions proportionately. Always remember that your business is unique and no matter how similar it may appear to the competition, you have your own unique skill set and perspective. Therefore, you should not solely rely on these figures entirely but just have a look at them as mere references or a guide.

3. Planning your Capital is as important as P&L Projection

It is a keen observation that entrepreneurs often neglect to project their future cash flow assumptions back in their capitalization table but they will never forget to project their P & L Statement. Knowing the capitalization table is important for entrepreneurs as it helps them to pre-plan when the next round of funds is to be raised. Planning ensures that you’re prepared to grow your business but things are unpredictable; you may take longer than planned to prove your market fit, or you may find it difficult to connect with the right people to build a team, or your product may need more attention and an upgrade; anything can happen. Therefore, strategizing when to raise the next round seems to be a genuinely intelligent move.

Parting Words

As a company that has helped UAE Health Tech Company raise $5M, UK Food & Beverages Company raise $2M and many more, it becomes all the more important for me to gladly break it to you that your valuation is negotiable. Your valuation serves as a promise that you’ll perform par excellence to achieve your goals. Fundraising, thus at seed stage, is an amalgamation of convincing the investors, exploring the opportunities offered by the industrial trends and proving your market fit.

We optimize & accelerate growth for already great products.

Business Investors Near Me: A Local Perspective

Local investors are the heartbeat of community-driven growth. Beyond funding, they bring insights, connections, and shared values. In the nexus of business and locality, their presence becomes a catalyst, propelling businesses to thrive within the unique tapestry of our local landscape.