Latest Articles

Funding For Startups

Venture Capital Funding: What You Need to Know

Venture Capital Funding is a dynamic financing avenue for startups, involving investors providing capital in exchange for equity. Key considerations include a robust business plan, team expertise, and market potential. The funding process spans various stages, from seed to Series funding, with exits through IPOs or acquisitions. Understanding this landscape is crucial for aspiring entrepreneurs

Navigating the World of Angel Investors and Private Investors

ChatGPT Embarking on entrepreneurial journeys, startups navigate the realm of angel and private investors. These individual backers, motivated by financial returns and a passion for innovation, provide crucial capital. As strategic partners, they not only fund but mentor, shaping the trajectory of startups and propelling them towards success in the competitive business landscape....

Navigating the Seed Funding Stage: Tips from Venture Capitalists

Navigating the seed funding stage is a crucial step for startups. Venture capitalists advise entrepreneurs to focus on idea validation, build strong teams, and create compelling pitches. Traction and user acquisition are vital, as is demonstrating a solid product-market fit. Effective communication and relationship-building with investors also play a key role in securing seed funding....

Choosing the Right Path: Venture Capital or Angel Investment?

In the startup universe, venture capital offers jet fuel for growth, enabling rapid expansion but often demanding equity and control. On other hand Angel investment, with its personal touch and mentorship, nurtures early-stage ideas, tolerating risk and shaping promising concepts into future success stories. Both paths are crucial, each with its unique advantages....

How to Approach Angel Investors: Do’s and Don’ts for Startups

In the challenging world of startup funding, approaching angel investors is a critical step. Learn the essential "do's" for success, And avoid common "don'ts" ...

A Comprehensive Guide to Startup Fundraising Strategies

Unlock the secrets to successful startup fundraising with our comprehensive guide. Explore strategies from bootstrapping to crowdfunding. ...

The Evolution of Startups: From Seed Funding to Series Funding

Whether you are starting or scaling your business, this guide will take you through every stage of fundraising, including the growth of fundraising culture, and what it all means for you....

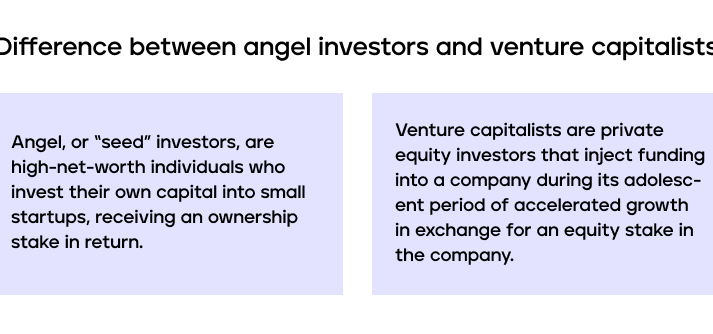

The Key Differences Between Venture Capital and Angel Investors

Explore the world of startup funding and the key differences between Venture Capital and Angel Investors. Learn how to make informed decisions for your business journey, weighing the pros and cons of each financing option. ...

The Anatomy of a Successful Pitch Deck: What to Include and How to structure it

Uncover the key components and effective structuring techniques for a successful pitch deck. Learn what to include in your pitch deck to capture investors' attention. Learn more. ...

How to Find the Right Investors for Your Startup: Strategies for Identifying and Targeting Potential Investors

Discover effective strategies for finding the ideal investors for your startup. Explore networking techniques, and investor research to optimize your fundraising efforts....

The Pros and Cons of Raising Funds From Friends and Family.

Explore the potential benefits of personal relationships, financial considerations, and potential challenges involved in this funding option for your entrepreneurial journey. ...

Leveraging Corporate Venture Capital for Growth

Learn how to strategically leverage corporate venture capital to drive business growth. Explore your growth strategy, new opportunities, and fostering innovation with Marquee Equity. ...

Strategies for Generating Returns from Venture Capital Investments

Discover proven strategies for generating returns from venture capital investments. Explore industry insights to maximize your investment portfolio with Marquee Equity. ...

Final Stages of Startup Funding: Tips for Successful Exits and Acquisitions

Learn how to prepare for the final stages of startup funding with our expert advice on exits and acquisitions, maximize chances of success and secure the best possible....

Illustrated Journey Through the Startup Funding Stages: Seed to IPO

Learn the stages of startup funding in detail, from pre-seed to IPO. Our comprehensive guide includes expert tips and advice to help you secure funding for your startup....

Impact of Equity Financing in Raising Debt | Marquee Equity

Impact of Equity Financing is often referred to as financial leverage. Taking on additional debt, the company gives the assurance to repay the loan and incurs the cost of interest. Read more. ...

Startup Growth Strategies to Prevent Your Startup From Failing

Boost your startup's success with effective growth strategies. Learn how to avoid common pitfalls and prevent failure with our comprehensive guide on startup growth strategies ...

The startup periodic table

What are startup periodic tables, and more importantly, how can they help you? Find out here....

Common securities – How do companies fund their operations?

Companies fund their operations through loans, investments, and common securities such as stocks and bonds. In this article let us discuss in detail about ways of startup funding operations. ...

A GUIDE ON IMPACT INVESTORS AND FUND MANAGERS

Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains. ...

What are the Common Securities in Fundraising?

SAFE agreements are legal contracts that startups use to raise seed financing capital. Read our comprehensive guide to fundraising with SAFE....

What is a Convertible Note: Every Startup should know

A short-term loan instrument that converts to equity is convertible note. The convertible debt in seed financing often transforms automatically into company shares. Read More. ...

Startup employee equity every founder should know

Employees having startup equity stocks can incentivize them to your business. Startups can not provide competitive remunerations but ESOPs can be a game changer. Read more. ...

A GUIDE ON STARTUP METRICS THAT EVERY FOUNDER SHOULD TRACK

Tracking the metrics for a startup can be intimidating as there are numerous parameters that must be tracked, bet these metrics will help you keep a pulse on where your startup stands....

3 Tips to Value your Seed Stage Startup for Successful Fundraising

Interactions with more than 100+ startups every week has made me realize that most of the founders are concerned about their business valuation. This is because raising capital successfully in the initial stages is directly proportional to the accuracy of their startup valuation. So, let’s understand how business valuation predominates the capital funding process at the seed-stage....

Crowdfunding vs. Angel Investing : How to Raise Money for Your Startup?

How to choose between crowdfunding and angel investing for your startup? You need to understand the difference between the two types of funding and their respective pros and cons and reach an informed decision that is best suited for your business....

7 ways to position your startup for funding

What is the recipe of a successful startup? Well, as they say, vision and actions go hand in hand. You should have an out of the box idea and business vision which should be backed up by strategic execution while startup fundraising and excellent products or services....