Latest Articles

How to Raise Funds for Hardware Startup Businesses?

Fundraising for hardware Startups Helps you to bring out your product to market. This Article helps you with different fundraising strategies. ...Read More...

How to Manage Dilution on Early Stage Startups

Equity dilution can reduce the founder's financial stake and ownership in the company. In this article let us see how equity dilution works in the pre and post-money SAFEs. ...

How does Startup Syndicate Funding Works

A syndicate investment mechanism enables several independent investors to pool their funds and participate with other reputable investors to invest in some of the best startups. Know more. ...

Strategies on Startup funding for small Businesses

Startup funding strategies are essential for your firm. We will discuss some business funding strategies for small businesses which will help you be on the path of constant growth. Know more....

Venture Capital and Private Equity : What’s the Difference

Understand whether private and venture equity setup would best suit you if you're a business founder or looking to establish your own firm soon. Know more....

What is Equity Crowdfunding? The Ultimate Guide for Founders

Owing to technological advancements, raising capital has emerged as democratic as well as convenient way of fundraising than the conventional methods. And one of the unconventional and blooming methods is equity crowdfunding. It facilitates the entrepreneurs' access to raise capital from accredited as well as non-accredited investors. Interesting, isn’t it? Therefore, in this write-up we’ll discuss equity crowdfunding....

7 Business Valuation Methods You Should Know

Whether you’re raising funds or contemplating selling your business, business valuation is a significant but an irksome task. There are a lot of complex methodical procedures which make it intimidating for a start-up owner to successfully evaluate the business. In this write-up, we will share some of the most common business valuation methods....

What’s The Difference Between Angel Investors and Venture Capitalists?

While raising capital via angel investment or venture funding, startups receive financial aid in exchange for equity and may have to forsake some company operational control. Check out the 2022 Guide to Investment with angel investors vs venture capitalists to know which financing model suits your business needs....

What is Seed Funding?

Is a brilliant out of the box idea enough for a business to succeed? Of course, not! Seed funding is the first official equity funding stage that will help scale and kickstart your business....

What is the Future of Venture Capital?

VC remains a lucrative fundraising model for businesses, however, the model is ripe for innovation. In this article we have explored the current state and our prediction of the future of venture capital....

What Do You Need To Know Before Raising Venture Capital?

Looking to raise capital? Join the many other entrepreneurs in line. Raising venture capital is one of the most complex funding journeys an entrepreneur goes through and only a few ace. Here’s how you can prepare yourself to be the latter. ...

The Basics of Raising Capital for a Startup

As an entrepreneur you can understand how difficult raising capital for business can be. Having an out of the box idea for your startup is not enough, raising capital is the key to kickstart your business....

The Fundraising Documents Founders Should Have Before They Pitch

Imagine being in the conference room with the investors, pitching your business only to find that you don’t have all the necessary fundraising documents. Sounds stressful, doesn’t it? Let us help you. ...

The Ease of Fund Raising Via Private Placement of Shares

The growth of the private placement market has led to an easier fund raising process with improved standardization of documentation, visibility of pricing as well as increased capacity for financings. So, the private placement market can accommodate transactions as small as $10 million and as large as $1-$2 billion. ...

What are the top fundraising trends in private equity?

Fundraising trends in private equity is on an unprecedented rise. The trends show that the current state of fundraising has already reached the pre-covid state. Know about the trends here....

How To Rise Above The Noise When Raising Capital

Confused about how to rise above the noise while raising capital for your business? We got you covered! In this write-up, we share the best practices that will help you raise capital, leverage your networks and create a compelling business pitch....

How to de-risk a startup to become investment-friendly?

De-risking a startup is what new entrepreneurs need to launch a successful business right off the ground. Moreover, it helps them get closer to getting startup funding. With over 90% of startups failing in a few years after their launch, de-risking is something that can help lower this percentage....

Short-term and Long-term financing: A pocket guide for businesses

A company, especially one at a growing stage, requires funds. It could be to get help with hiring activities, to buy inventory,...

What is a 409A Valuation and When Should You Get it?

In a startup, salaries tend to take up a huge portion of the cash flow. However, it is unquestionable that in order...

How Rolling Funds Will Impact Fundraising

Rolling funds is the next big thing when it comes to fundraising. Did you know that rolling venture funds work for experienced...

What Should an Entrepreneur Know About Cap Table?

Suppose your brand is a Netflix series, the cap table will be the closing captions addressing who did what. For any entrepreneur,...

Guide to Investor Pitch Decks for Startups

We know you must have heard and read how an investor pitch deck should be more than data points – it should...

8 Things to Avoid When Making a Killer Business Pitch

Raising funds for your business can be extremely tricky. Business pitches can either create or shatter the ‘investor capital bridge’ for any...

What Are The Different Startup Funding Stages?

Irrespective of what stage you are in your entrepreneurial journey – whether you are starting a new business, you have an established...

How to Find and Attract Investors Remotely?

In the last two years, or what we call it as the COVID era, a lot has changed on the business front....

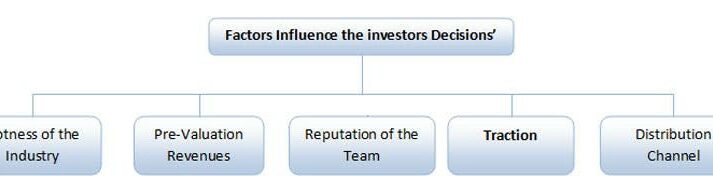

What Do Startup Investors Look for?

The percent of startups that close VC funding rounds range from 0.04-0.07%. Dire as these numbers are, the efforts to woo investors...

The Ultimate Guide to Startup Funding

According to statistics, only 0.91% startups get funded by the angel investors, while a mere 0.05 percent are funded by the VCs....

Where to Find Business Investors and How to Attract Them?

Let’s be honest. The probability of receiving an unexpected call from a big venture capital firm or an angel investor or from...

What Are the Common Raising Capital Challenges and How To Overcome Them?

The venture capital market in the US alone stands at $49.9 billion while the startups that get funded stands at 0.05 of...

5 Reasons Why Your Startup Should Get Funding

If you have an out of the box idea and the willpower to succeed, you have passed stage one. But is that...

How to Create a Successful Business Pitch

Investors generally work with a mindset that out of every 100 investments which they make in an early-stage startup, only 10 will...

The Importance of Funding for Businesses

A business empire is not built on blood and sweat alone. Even Steve Jobs had to sell his Volkswagen car to fund...

What’s your company worth? How valuations work.

300+ companies. Is how many startups our team at Marquee Equity speaks to each week. The top 3 questions we hear are: How much...

Startup Fundraising Data 2019

It’s been a very interesting start to the startup fundraising activity in 2019. Globally, deal volumes and sizes were expected to reduce,...

Should you be looking to raise institutional (VC/PE) capital?

My work over the past 7 years has largely revolved around helping companies raise capital and building technology to help them do...